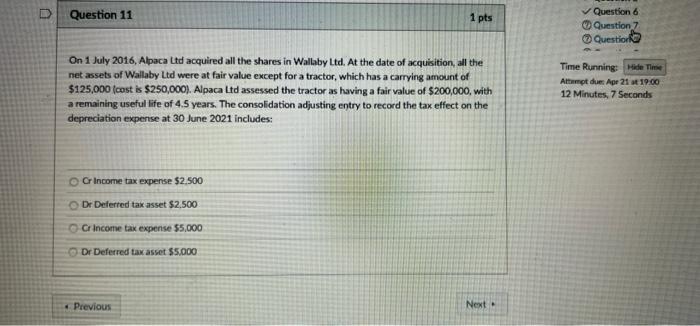

Question: Question 11 1 pts Question 6 Question 7 Question On 1 July 2016, Alpaca Ltd acquired all the shares in Wallaby Ltd. At the date

Question 11 1 pts Question 6 Question 7 Question On 1 July 2016, Alpaca Ltd acquired all the shares in Wallaby Ltd. At the date of acquisition, all the net assets of Wallaby Ltd were at fair value except for a tractor, which has a carrying amount of $125,000 cost is $250,000). Alpaca Ltd assessed the tractor as having a fair value of $200,000, with a remaining useful life of 4.5 years. The consolidation adjusting entry to record the tax effect on the depreciation expense at 30 June 2021 includes: Time Running Mide The Attempt due: Apr 21 19.00 12 Minutes, 7 Seconds CrIncome tax expense $2.500 Dr Deferred tax asset $2.500 Ce Income tax expense 55.000 Dr Deferred tax asset $5.000 . Previous Next

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts