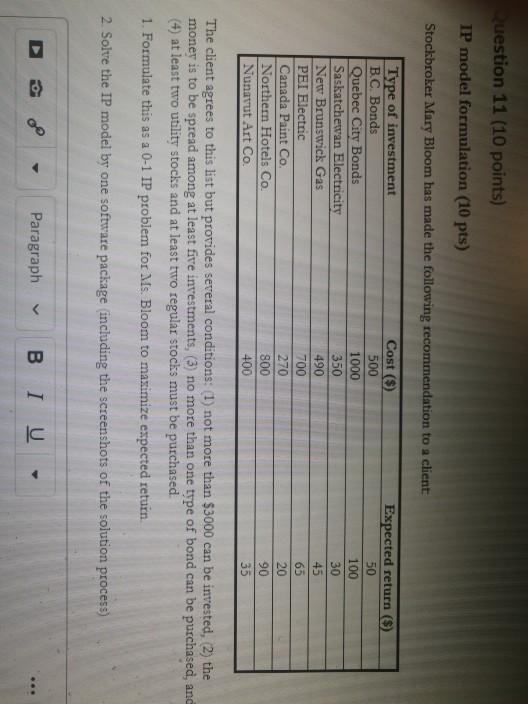

Question: Question 11 (10 points) IP model formulation (10 pts) Stockbroker Mary Bloom has made the following recommendation to a client Cost (%) Type of investment

Question 11 (10 points) IP model formulation (10 pts) Stockbroker Mary Bloom has made the following recommendation to a client Cost (%) Type of investment B.C. Bonds Quebec City Bonds Saskatchewan Electricity New Brunswick Gas PEI Electric Canada Paint Co. Northern Hotels Co. Nunavut Art Co. 500 1000 350 490 Expected return ($) 50 100 30 45 65 20 90 35 700 270 800 400 The client agrees to this list but provides several conditions: 1) not more than $3000 can be invested, 2) the money is to be spread among at least five investments, (3) no more than one type of bond can be purchased, and (4) at least two utility stocks and at least two regular stocks must be purchased. 1. Formulate this as a 0-1 IP problem for Ms. Bloom to maximize expected return 2. Solve the IP model by one software package including the screenshots of the solution process) Paragraph BI U Question 11 (10 points) IP model formulation (10 pts) Stockbroker Mary Bloom has made the following recommendation to a client Cost (%) Type of investment B.C. Bonds Quebec City Bonds Saskatchewan Electricity New Brunswick Gas PEI Electric Canada Paint Co. Northern Hotels Co. Nunavut Art Co. 500 1000 350 490 Expected return ($) 50 100 30 45 65 20 90 35 700 270 800 400 The client agrees to this list but provides several conditions: 1) not more than $3000 can be invested, 2) the money is to be spread among at least five investments, (3) no more than one type of bond can be purchased, and (4) at least two utility stocks and at least two regular stocks must be purchased. 1. Formulate this as a 0-1 IP problem for Ms. Bloom to maximize expected return 2. Solve the IP model by one software package including the screenshots of the solution process) Paragraph BI U

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts