Question: Question 11 10 points Save Answer Precision Manufacturing is considering the purchase of a machine for $500,000. Aternatively, the machine could be leased on a

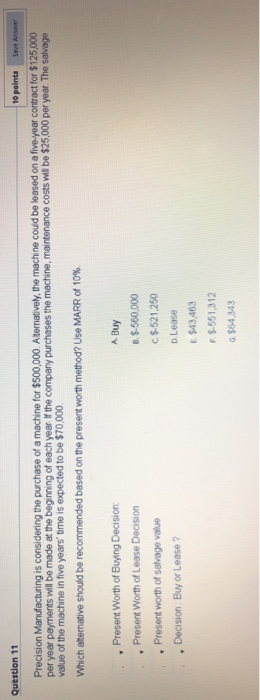

Question 11 10 points Save Answer Precision Manufacturing is considering the purchase of a machine for $500,000. Aternatively, the machine could be leased on a five-year contract for $125,000 per year payments will be made at the beginning of each year. If the company purchases the machine, maintenance costs will be $25,000 per year. The salvage value of the machine in five years' time is expected to be $70,000 Which alternative should be recommended based on the present worth method? Use MARR of 10% A Buy Present Worth of Buying Decision Present Worth of Lease Decision Present worth of salvage value Decision Buy or Lease ? B. $-560,000 C$-521.250 D.Lease $43,463 F$-551,312 G.$64,343

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts