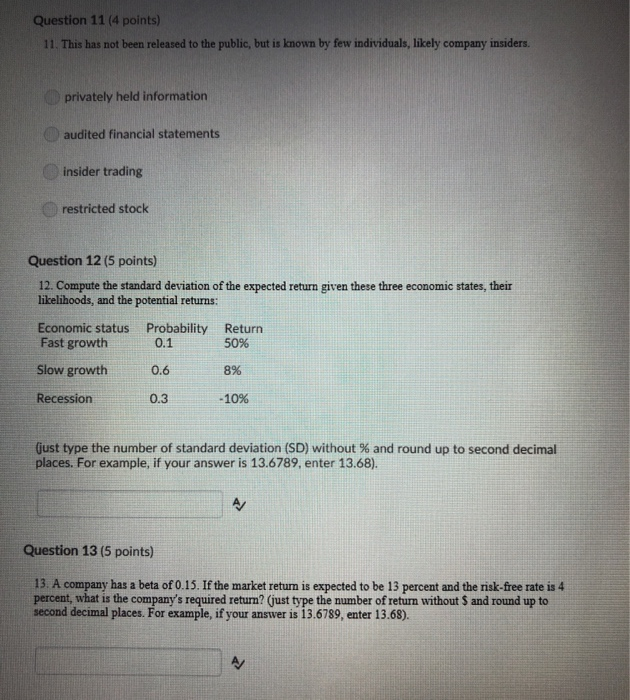

Question: Question 11 (4 points) 11. This has not been released to the public, but is known by few individuals, likely company insiders. privately held information

Question 11 (4 points) 11. This has not been released to the public, but is known by few individuals, likely company insiders. privately held information audited financial statements insider trading restricted stock Question 12 (5 points) 12. Compute the standard deviation of the expected return given these three economic states, their likelihoods, and the potential returns: Economic status Fast growth Probability 0.1 Return 50% Slow growth 0.6 8% Recession -10 % 0.3 Gust type the number of standard deviation (SD) without % and round up to second decimal places. For example, if your answer is 13.6789, enter 13.68) Question 13 (5 points) 13. A company has a beta of 0.15. If the market retun is expected to be 13 percent and the risk-free rate is 4 percent, what is the company's required return? (just type the number of return without $ and round up to second decimal places. For example, if your answer is 13.6789, enter 13.68)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts