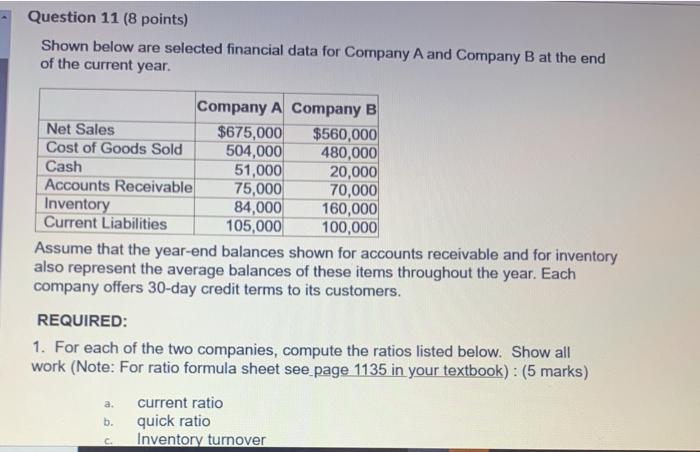

Question: Question 11 (8 points) Shown below are selected financial data for Company A and Company B at the end of the current year. Company A

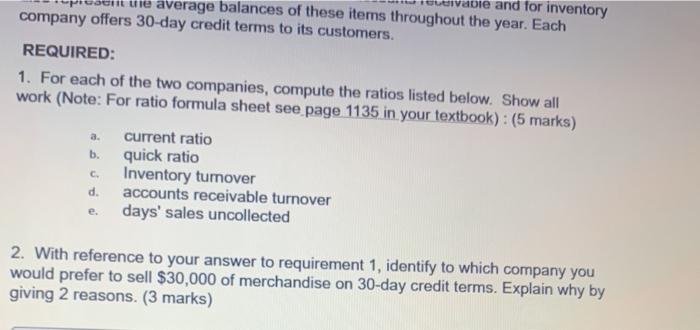

Question 11 (8 points) Shown below are selected financial data for Company A and Company B at the end of the current year. Company A Company B Net Sales $675,000 $560,000 Cost of Goods Sold 504,000 480,000 Cash 51,000 20,000 Accounts Receivable 75,000 70,000 Inventory 84,000 160,000 Current Liabilities 105,000 100,000 Assume that the year-end balances shown for accounts receivable and for inventory also represent the average balances of these items throughout the year. Each company offers 30-day credit terms to its customers. REQUIRED: 1. For each of the two companies, compute the ratios listed below. Show all work (Note: For ratio formula sheet see page 1135 in your textbook) : (5 marks) current ratio b. quick ratio Inventory turnover a. vable and for inventory uve average balances of these items throughout the year. Each company offers 30-day credit terms to its customers. REQUIRED: 1. For each of the two companies, compute the ratios listed below. Show all work (Note: For ratio formula sheet see page 1135 in your textbook): (5 marks) current ratio b. quick ratio Inventory tumover accounts receivable turnover days' sales uncollected a. C d. 2. With reference to your answer to requirement 1, identify to which company you would prefer to sell $30,000 of merchandise on 30-day credit terms. Explain why by giving 2 reasons

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts