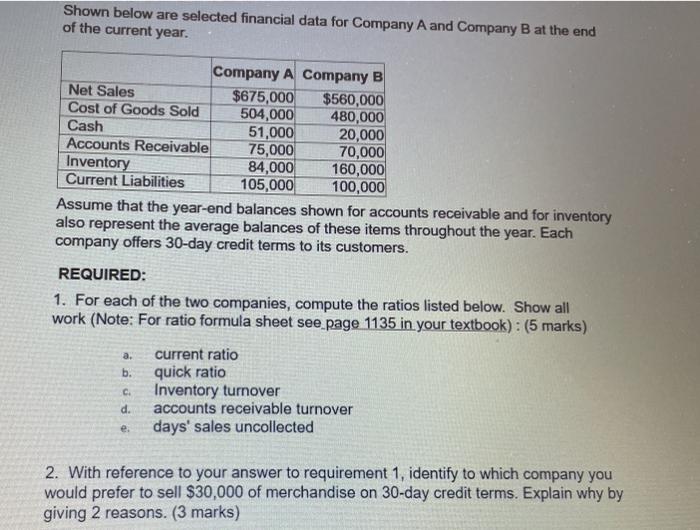

Question: Shown below are selected financial data for Company A and Company B at the end of the current year. Company A Company B Net Sales

Shown below are selected financial data for Company A and Company B at the end of the current year. Company A Company B Net Sales $675,000 $560,000 Cost of Goods Sold 504,000 480,000 Cash 51,000 20,000 Accounts Receivable 75,000 70,000 Inventory 84,000 160,000 Current Liabilities 105,000 100,000 Assume that the year-end balances shown for accounts receivable and for inventory also represent the average balances of these items throughout the year. Each company offers 30-day credit terms to its customers. REQUIRED: 1. For each of the two companies, compute the ratios listed below. Show all work (Note: For ratio formula sheet see page 1135 in your textbook) : (5 marks) a. b. C d. current ratio quick ratio Inventory turnover accounts receivable turnover days' sales uncollected e. 2. With reference to your answer to requirement 1, identify to which company you would prefer to sell $30,000 of merchandise on 30-day credit terms. Explain why by giving 2 reasons

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts