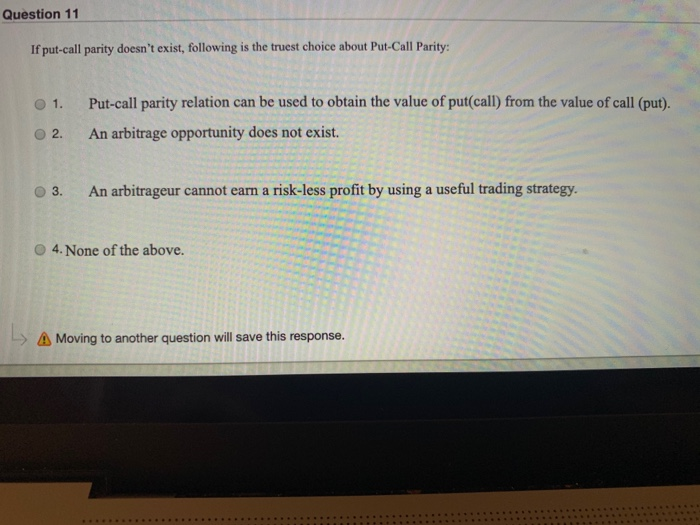

Question: Question 11 If put-call parity doesn't exist, following is the truest choice about Put-Call Parity: 1. 2. Put-call parity relation can be used to obtain

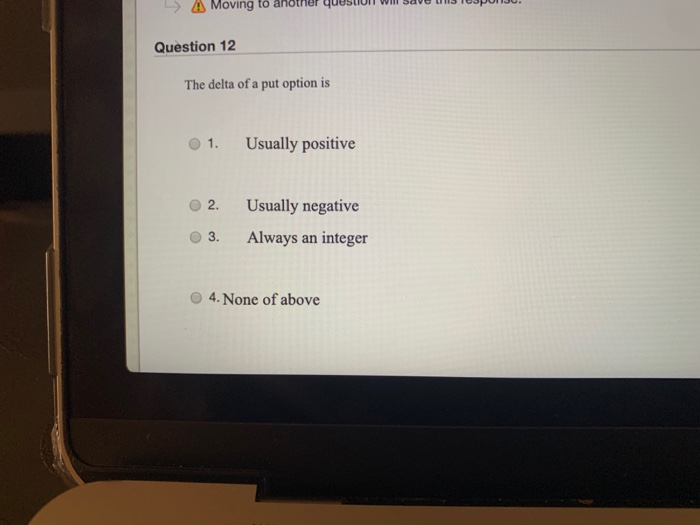

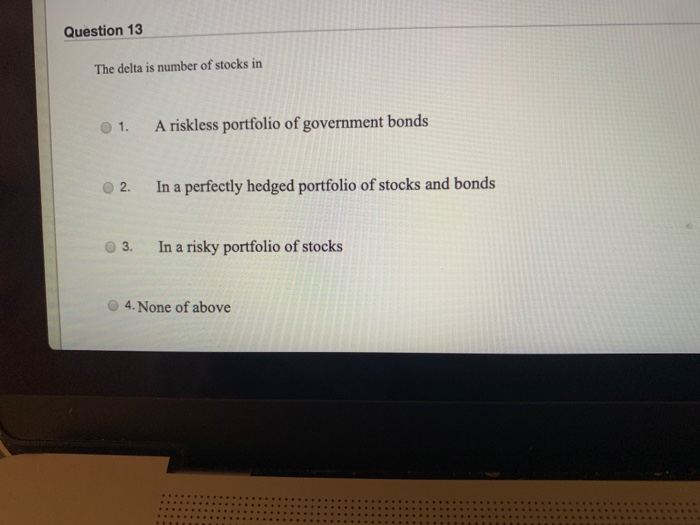

Question 11 If put-call parity doesn't exist, following is the truest choice about Put-Call Parity: 1. 2. Put-call parity relation can be used to obtain the value of put(call) from the value of call (put). An arbitrage opportunity does not exist. 3. An arbitrageur cannot earn a risk-less profit by using a useful trading strategy. 4. None of the above. > A Moving to another question will save this response. A Moving to another question will JUU Question 12 The delta of a put option is 1. Usually positive 2. Usually negative 3. Always an integer 4. None of above Question 13 The delta is number of stocks in 1. A riskless portfolio of government bonds 2. In a perfectly hedged portfolio of stocks and bonds 3. In a risky portfolio of stocks 4. None of above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts