Question: QUESTION 11 Merrimack is evaluating a project that will increase sales by $875,000 and costs by S492,000. The project will initially cost $2,340,000 for fixed

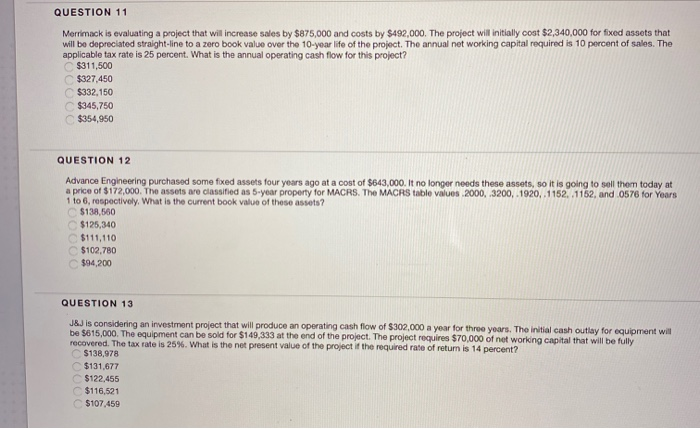

QUESTION 11 Merrimack is evaluating a project that will increase sales by $875,000 and costs by S492,000. The project will initially cost $2,340,000 for fixed assets that will be depreciated straight-line to a zero book value over the 10-year life of the project. The annual net working capital required is 10 percent of sales. The applicable tax rate is 25 percent. What is the annual operating cash flow for this project? $311,500 $327,450 $332,150 $345,750 $354,950 QUESTION 12 Advance Engineering purchased some fixed assets four years ago at a cost of $643,000. It no longer needs these assets, so it is going to sell them today at a price of $172,000. The assets are classified as 5-year property for MACRS. The MACRS table values 2000, 3200, 1920, 1152, 1152, and .0576 for Years 1 to 6, respectively. What is the current book value of these assets? $138,500 $125,340 $111,110 $102,780 $94,200 QUESTION 13 J&J is considering an investment project that will produce an operating cash flow of $302,000 a year for three years. The initial cash outlay for equipment will be $615,000. The equipment can be sold for $149,333 at the end of the project. The project requires $70,000 of not working capital that will be fully recovered. The tax rate is 25%. What is the net present value of the project if the required rate of retum is 14 percent? $138,978 $131,677 $122.455 $116,521 $107.459

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts