Question: PROFITABILITY INDEX PROPOSAL 1 = 1.62 PROPOSAL 2 = 0.998 PROPOSAL 1 IS BETTER QUESTION 12. PAYBACK PERIOD PROPOSAL 1 = 1.92 YEARS PROPOSAL 2

PROFITABILITY INDEX

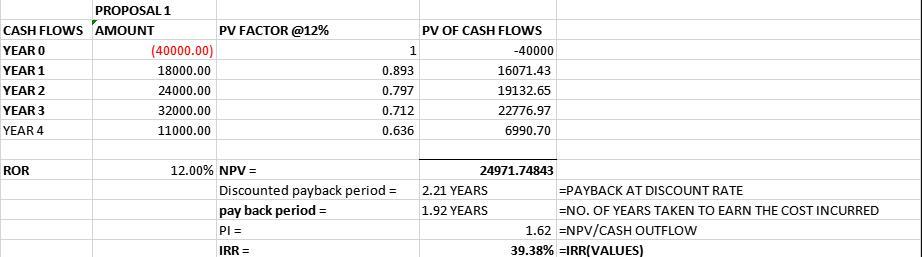

PROPOSAL 1 = 1.62

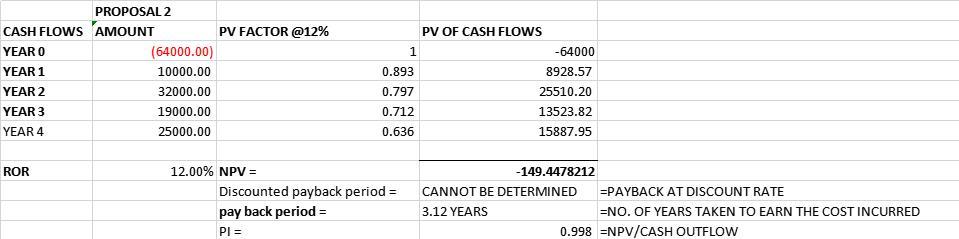

PROPOSAL 2 = 0.998

PROPOSAL 1 IS BETTER

QUESTION 12.

PAYBACK PERIOD

PROPOSAL 1 = 1.92 YEARS

PROPOSAL 2 = 3.12 YEARS

PROPOSAL 1 IS BETTER

QUESTION 13

NPV

PROPOSAL 1 = 24971.75

PROPOSAL 2 = -149.45

PROPOSAL 1 IS BETTER

QUESTION 14

DISCOUNTED PAYBACK PERIOD

PROPOSAL 1 = 2.21 YEARS

PROPOSAL 2 = CANNOT BE DETERMINED

PROPOSAL 1 IS BETTER

QUESTION 15

IRR

PROPOSAL 1 = 39.38%

PROPOSAL 2 = 11.90%

PROPOSAL 1 IS BETTER

PROPOSAL 1 CASH FLOWS AMOUNT PV FACTOR @12% PV OF CASH FLOWS YEAR O (40000.00) -40000 YEAR 1 18000.00 0.893 16071.43 YEAR 2 24000.00 0.797 19132.65 YEAR 3 32000.00 0.712 22776.97 YEAR 4 11000.00 0.636 6990.70 ROR 12.00% NPV = 24971.74843 Discounted payback period = 2.21 YEARS =PAYBACK AT DISCOUNT RATE pay back period = PI = 1.92 YEARS =NO. OF YEARS TAKEN TO EARN THE COST INCURRED 1.62 =NPV/CASH OUTFLOW IRR = 39.38% =IRR(VALUES)

Step by Step Solution

3.48 Rating (161 Votes )

There are 3 Steps involved in it

1 1st one is better CF CF DF PV1 PV2 40000 64000 1 40000 64000 18000 10000 0892857 1607... View full answer

Get step-by-step solutions from verified subject matter experts