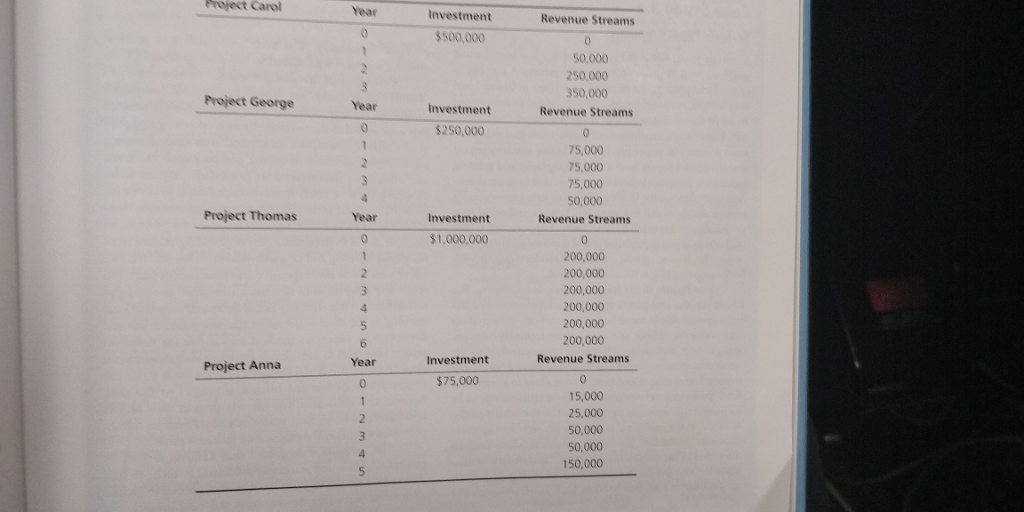

Question: Question 11: Net Present Value: A company has four project investments alternatives. The required rate of return on projects is 20% and inflation is projected

Question 11: Net Present Value: A company has four project investments alternatives. The required rate of return on projects is 20% and inflation is projected to remain at 3% into the foreseeable future.

helt tive price the years. purchase (including The installation and testing) of the new system is $105,250. The system is expected to have a useful life of five years, after which time it can be sold in the secondary computer systems market for $10,250. What is the net present value of this investment if the discount rate is 8.5% per year? 11. Net Present Value. A company has four project investment alter- natives. The required rate of return on projects is 20%, and infla- tion is projected to remain at 3% into the foreseeable future. The pertinent information about each alternative is listed in the chart: Which project should be the firm's first priority? Why? If the company could invest in more than one project, indicate the order in which it should prioritize these project alternatives. 12. Options Model. A heavy manufacturing company wants to decide whether to initiate a new project. The success of the project depends heavily on the state of the economy, which has a 50/50 chance of being strong enough to support the venture

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts