Question: QUESTION 11 Practice finding Present Value for Semi-annual Bonds See Section 7-6 of the Textbook. Consider corporate bonds with PMT: a coupon rate of 5%

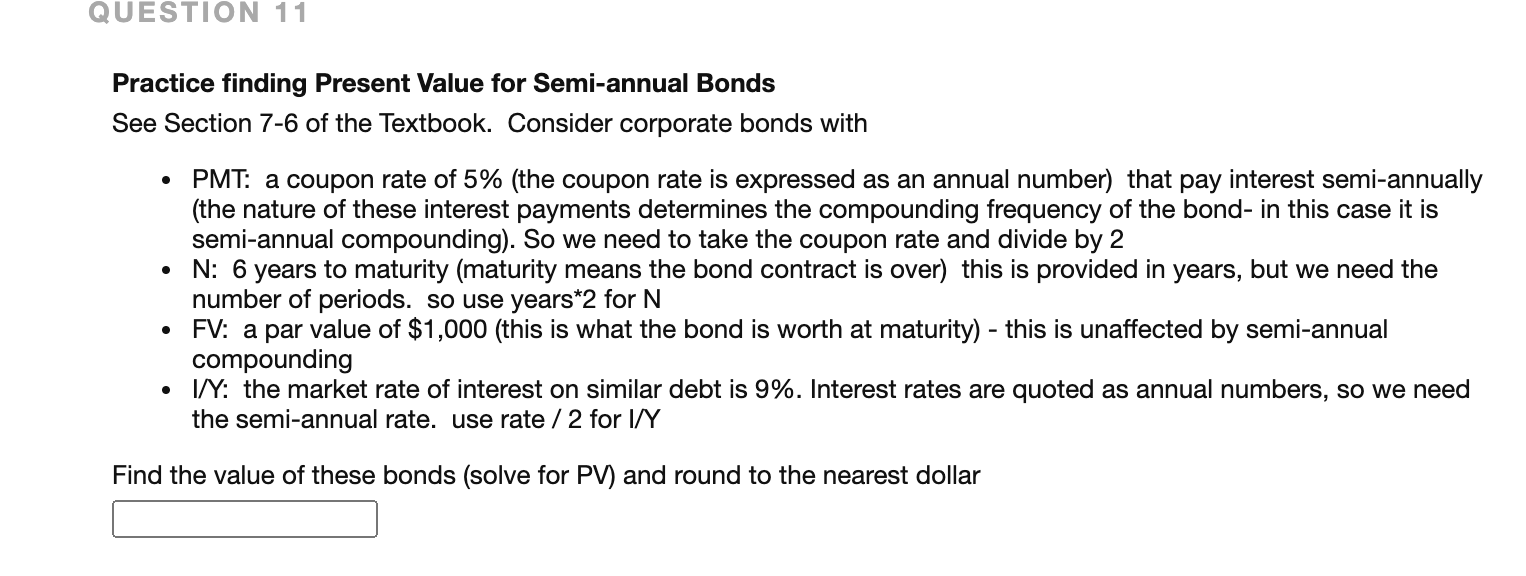

QUESTION 11 Practice finding Present Value for Semi-annual Bonds See Section 7-6 of the Textbook. Consider corporate bonds with PMT: a coupon rate of 5% (the coupon rate is expressed as an annual number) that pay interest semi-annually (the nature of these interest payments determines the compounding frequency of the bond- in this case it is semi-annual compounding). So we need to take the coupon rate and divide by 2 N: 6 years to maturity (maturity means the bond contract is over) this is provided in years, but we need the number of periods. so use years*2 for N FV: a par value of $1,000 (this is what the bond is worth at maturity) - this is unaffected by semi-annual compounding I/Y: the market rate of interest on similar debt is 9%. Interest rates are quoted as annual numbers, so we need the semi-annual rate. use rate / 2 for I/Y Find the value of these bonds (solve for PV) and round to the nearest dollar

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts