Question: QUESTION 9 Practice Calculating Present Value Consider corporate bonds with PMT: a coupon rate of 6% that pay interest annually (the nature of these interest

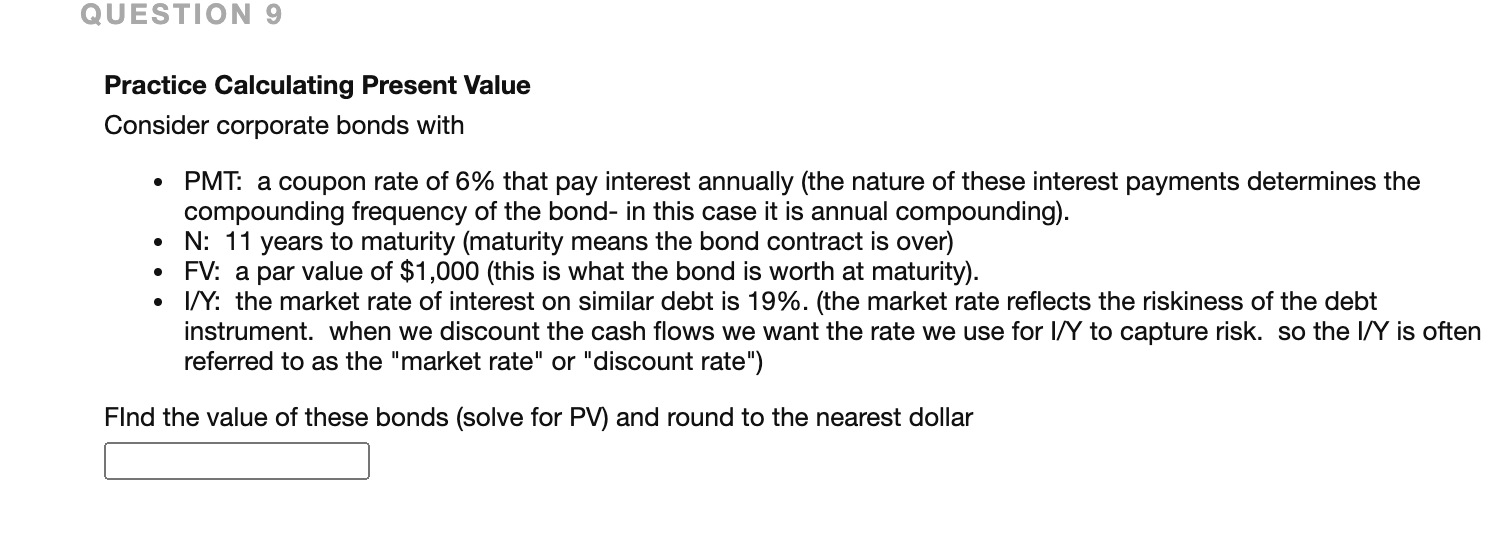

QUESTION 9 Practice Calculating Present Value Consider corporate bonds with PMT: a coupon rate of 6% that pay interest annually (the nature of these interest payments determines the compounding frequency of the bond- in this case it is annual compounding). N: 11 years to maturity (maturity means the bond contract is over) FV: a par value of $1,000 (this is what the bond is worth at maturity). I/Y: the market rate of interest on similar debt is 19%. (the market rate reflects the riskiness of the debt instrument. when we discount the cash flows we want the rate we use for I/ to capture risk. so the I/Y is often referred to as the "market rate" or "discount rate") . Find the value of these bonds (solve for PV) and round to the nearest dollar QUESTION 9 Practice Calculating Present Value Consider corporate bonds with PMT: a coupon rate of 6% that pay interest annually (the nature of these interest payments determines the compounding frequency of the bond- in this case it is annual compounding). N: 11 years to maturity (maturity means the bond contract is over) FV: a par value of $1,000 (this is what the bond is worth at maturity). I/Y: the market rate of interest on similar debt is 19%. (the market rate reflects the riskiness of the debt instrument. when we discount the cash flows we want the rate we use for I/ to capture risk. so the I/Y is often referred to as the "market rate" or "discount rate") . Find the value of these bonds (solve for PV) and round to the nearest dollar

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts