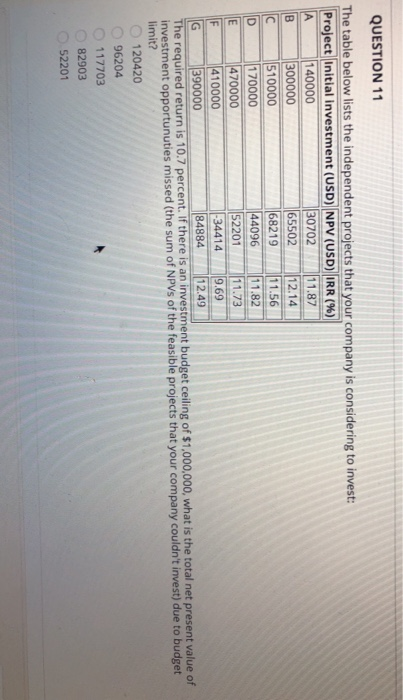

Question: QUESTION 11 The table below lists the independent projects that your company is considering to invest: Project Initial investment (USD) NPV (USD) IRR (%) A

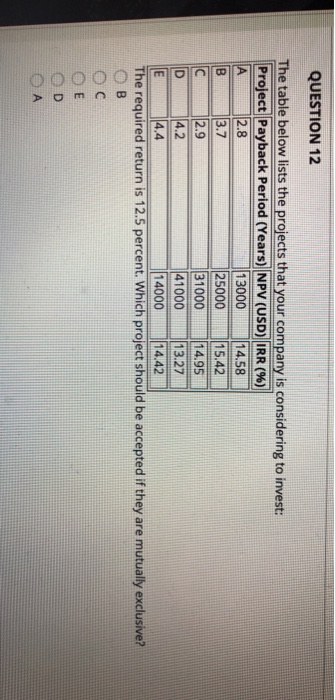

QUESTION 11 The table below lists the independent projects that your company is considering to invest: Project Initial investment (USD) NPV (USD) IRR (%) A 140000 30702 11.87 B 300000 65502 12.14 IC 510000 68219 11.56 D 170000 44096 11.82 470000 52201 11.73 410000 34414 9.69 G 390000 84884 12.49 The required return is 10.7 percent. If there is an investment budget ceiling of $1,000,000, what is the total net present value of investment opportunuties missed (the sum of NPVs of the feasible projects that your company couldn't invest) due to budget limit? 120420 E F OOOOO 96204 117703 82903 52201 QUESTION 12 The table below lists the projects that your company is considering to invest: Project Payback Period (Years) NPV (USD) IRR (%) 2.8 13000 14.58 B 3.7 25000 15.42 IC 2.9 31000 14.95 D 4.2 41000 13.27 E 4.4 14000 14.42 The required return is 12.5 percent. Which project should be accepted if they are mutually exclusive? B D

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts