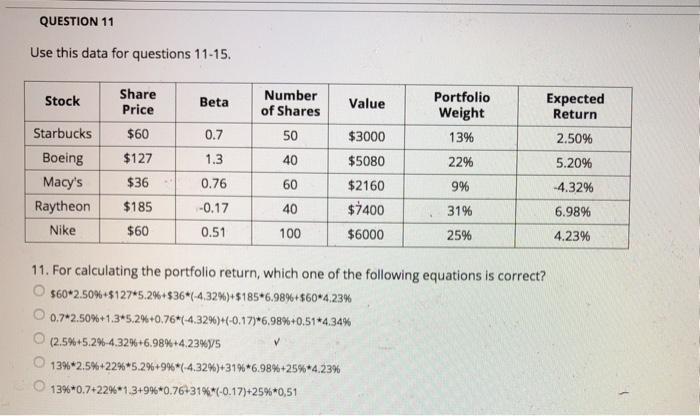

Question: QUESTION 11 Use this data for questions 11-15. Stock Beta Number of Shares Value Portfolio Weight 13% Expected Return 0.7 50 2.50% Share Price $60

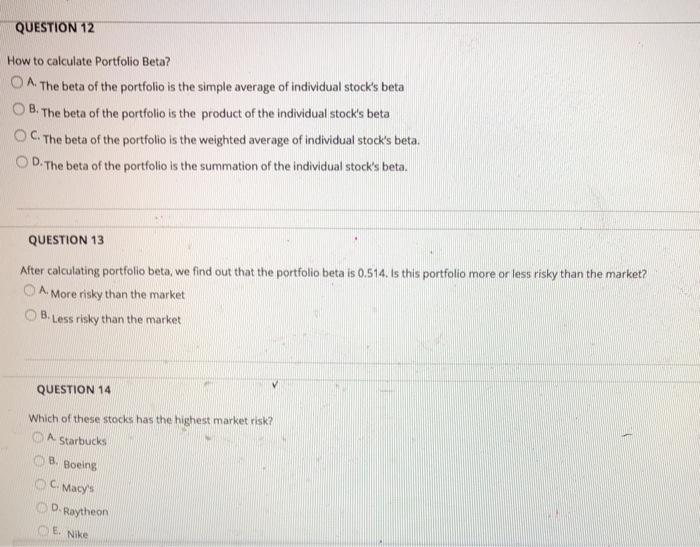

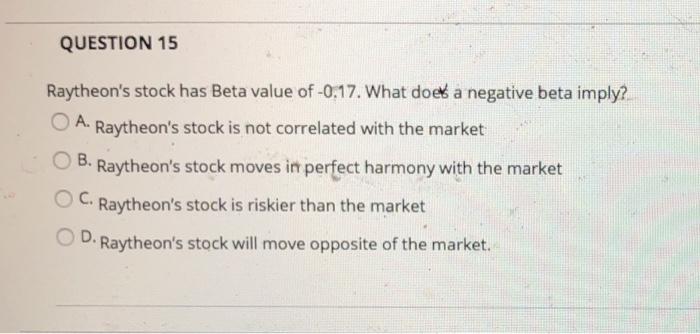

QUESTION 11 Use this data for questions 11-15. Stock Beta Number of Shares Value Portfolio Weight 13% Expected Return 0.7 50 2.50% Share Price $60 $127 $36 $185 $60 1.3 22% Starbucks Boeing Macy's Raytheon Nike 5.20% 0.76 $3000 $5080 $2160 $2400 $6000 9% 40 60 40 100 -4.32% -0.17 31% 6.98% 0.51 25% 4.23% 11. For calculating the portfolio return, which one of the following equations is correct? $60*2.50%+127*5.2% +$36*(-4.32%)*8185*6.98%+$60-4.23% 0.7*2.50%+1.345.2%+0.76*(-4.32%)*(-0.17)*6.98%+0.51*4.34% (2.5%+5.2% 4.32%+6.98%+4.2345 134*2.5%+22%*5.2%+9%*(-4.32%)+31%*6.98%+25%*4.23% 139*0.7+22%*1.3+94*0.76+31%*(-0.17)+25%*0,51 QUESTION 12 How to calculate Portfolio Beta? O A. The beta of the portfolio is the simple average of individual stock's beta OB. The beta of the portfolio is the product of the individual stock's beta OCThe beta of the portfolio is the weighted average of individual stock's beta. OD. The beta of the portfolio is the summation of the individual stock's beta. QUESTION 13 After calculating portfolio beta, we find out that the portfolio beta is 0.514. Is this portfolio more or less risky than the market? O A. More risky than the market O B. Less risky than the market QUESTION 14 Which of these stocks has the highest market risk? A Starbucks 8. Boeing Macy's D. Raytheon 6. Nike QUESTION 15 B. Raytheon's stock has Beta value of -0.17. What does a negative beta imply? A. Raytheon's stock is not correlated with the market Raytheon's stock moves in perfect harmony with the market Raytheon's stock is riskier than the market D. Raytheon's stock will move opposite of the market. C

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts