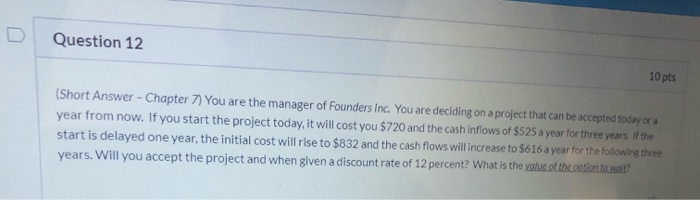

Question: Question 12 10 pts (Short Answer - Chapter 7) You are the manager of Founders Inc. You are deciding on a project that can be

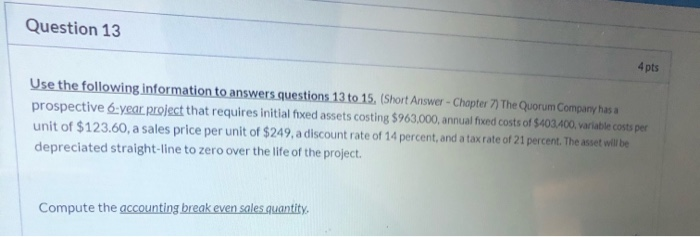

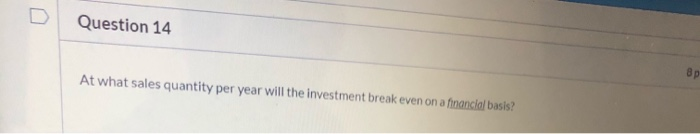

Question 12 10 pts (Short Answer - Chapter 7) You are the manager of Founders Inc. You are deciding on a project that can be accepted today or a year from now. If you start the project today, it will cost you $720 and the cash inflows of $525 a year for three years. If the start is delayed one year, the initial cost willl rise to $832 and the cash flows will increase to $616 a year for the following three years. Will you accept the project and when given a discount rate of 12 percent? What is the yalue of the option to wait? Question 13 4pts Use the following information to answers gquestions 13 to 15, (Short Answer-Chopter 7) The Quorum Company has a prospective 6-year project that requires initial fixed assets costing $963,000, annual fixed costs of $403400, variable costs per unit of $123.60, a sales price per unit of $249, a discount rate of 14 percent, and a tax rate of 21 percent. The asset will be depreciated straight-line to zero over the life of the project. Compute the accounting break even sales quantity. Question 14 8p At what sales quantity per year will the investment break even on a financlal basis? Question 15 Explain in words why is there a difference between the two answers

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts