Question: Question 12 (4 points) Brushy Mountain Mining Company's ore reserves are being depleted, so its sales are falling. Also, its pit is getting deeper each

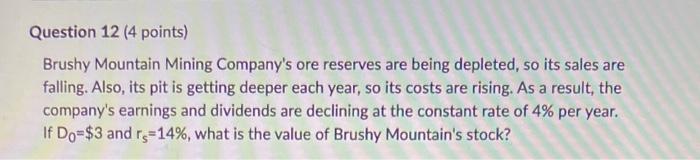

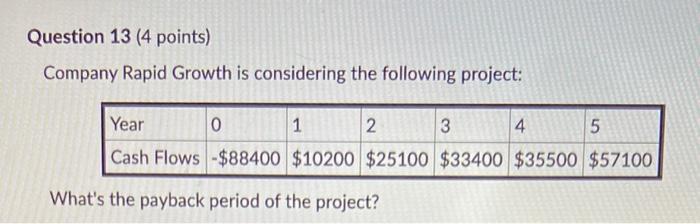

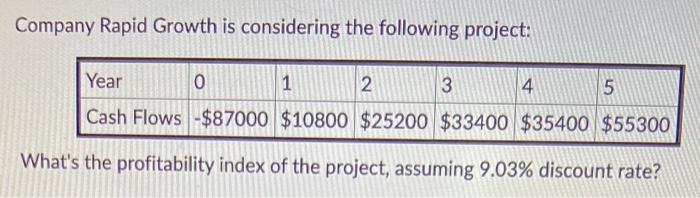

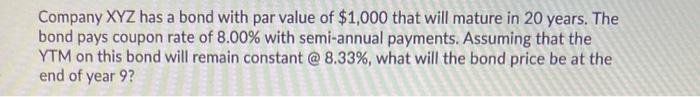

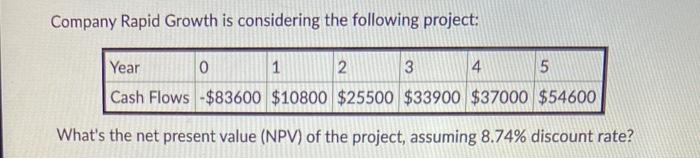

Question 12 (4 points) Brushy Mountain Mining Company's ore reserves are being depleted, so its sales are falling. Also, its pit is getting deeper each year, so its costs are rising. As a result, the company's earnings and dividends are declining at the constant rate of 4% per year. If Do=$3 and rs=14%, what is the value of Brushy Mountain's stock? Question 13 (4 points) Company Rapid Growth is considering the following project: Year 0 1 2. 3 4 5 Cash Flows -$88400 $10200 $25100 $33400 $35500 $57100 What's the payback period of the project? Company Rapid Growth is considering the following project: Year 0 1 2 3 4 5 Cash Flows -$87000 $10800 $25200 $33400 $35400 $55300 What's the profitability index of the project, assuming 9.03% discount rate? Company XYZ has a bond with par value of $1,000 that will mature in 20 years. The bond pays coupon rate of 8.00% with semi-annual payments. Assuming that the YTM on this bond will remain constant @ 8.33%, what will the bond price be at the end of year 92 Company Rapid Growth is considering the following project: Year 0 1 2 3 4 5 Cash Flows -$83600 $10800 $25500 $33900 $37000 $54600 What's the net present value (NPV) of the project, assuming 8.74% discount rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts