Question: Question 12 40 points Save Answer To compare across in a sector, you are looking to price-to-book value ratio. Given the relationship between price-to-book value

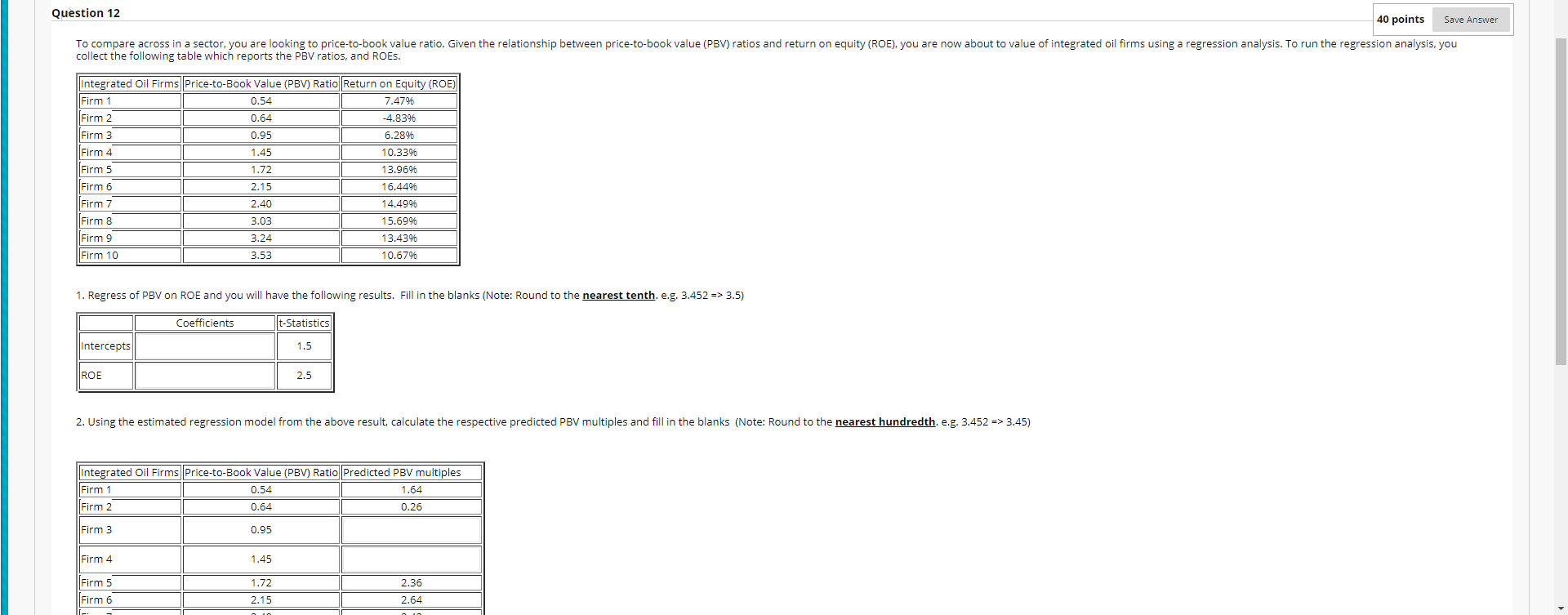

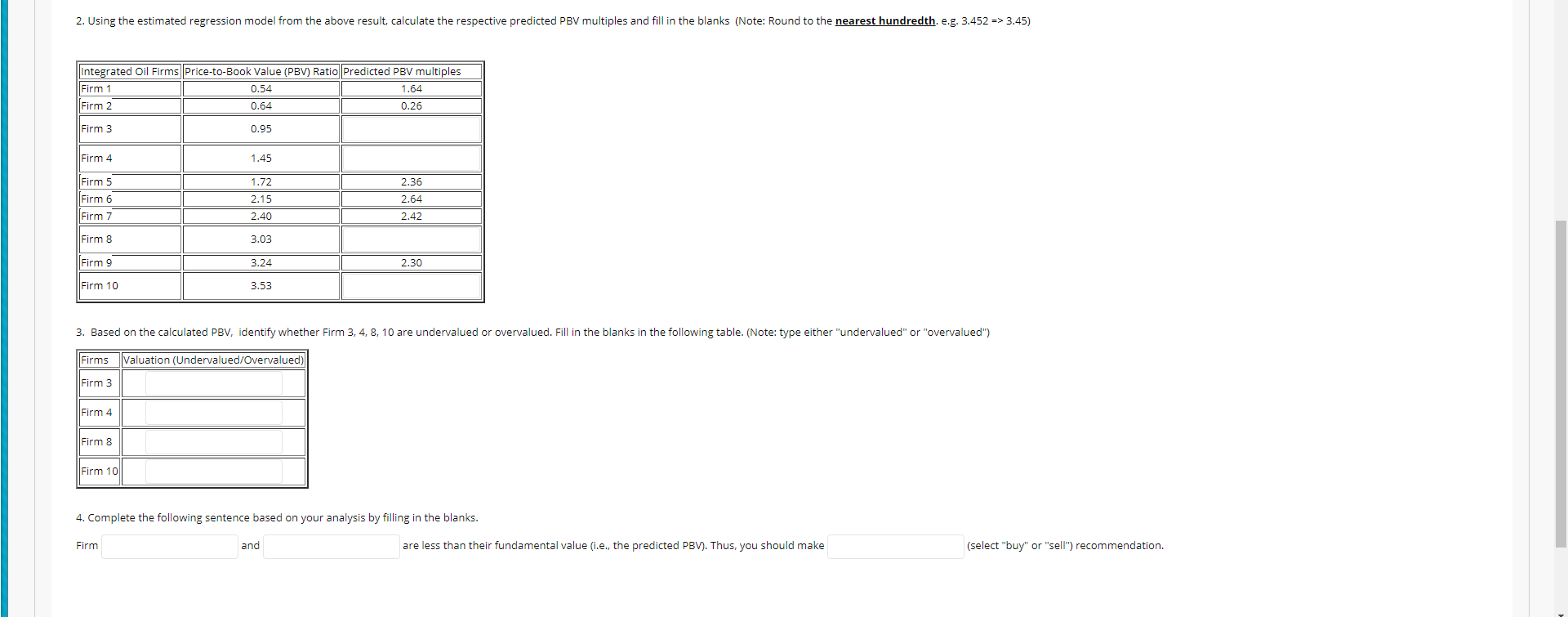

Question 12 40 points Save Answer To compare across in a sector, you are looking to price-to-book value ratio. Given the relationship between price-to-book value (PBV) ratios and return on equity (ROE), you are now about to value of integrated oil firms using a regression analysis. To run the regression analysis, you collect the following table which reports the PBV ratios, and ROES. Integrated Oil Firms Price-to-Book Value (PBV) Ratio Return on Equity (ROE) Firm 1 0.54 7.4796 Firm 2 0.64 -4.8396 Firm 3 0.95 6.2896 Firm 4 1.45 10.3396 | Firm 5 1.72 13.9696 Firm 6 2.15 16.4496 Firm 7 2.40 14.4996 IlFirm 8 3.03 15.6996 Firm 9 3.24 13.4396 Firm 10 3.53 10.67% 1. Regress of PBV on ROE and you will have the following results. Fill in the blanks (Note: Round to the nearest tenth. e.g. 3.452 => 3.5) Coefficients It-Statistics Intercepts 1.5 ROE 2.5 2. Using the estimated regression model from the above result, calculate the respective predicted PBV multiples and fill in the blanks (Note: Round to the nearest hundredth. e.g. 3.452 => 3.45) Integrated Oil Firms Price-to-Book Value (PBV) Ratio Predicted PBV multiples Firm 1 0.54 1.64 Firm 2 0.64 0.26 Firm 3 0.95 Firm 4 1.45 Firm 5 1.72 2.36 2.64 Firm 6 2.15 nin 2. Using the estimated regression model from the above result, calculate the respective predicted PBV multiples and fill in the blanks (Note: Round to the nearest hundredth. e.g. 3.452 => 3.45) Integrated Oil Firms Price-to-Book Value (PBV) Ratio Predicted PBV multiples Firm 1 0.54 1.64 Firm 2 0.64 0.26 Firm 3 0.95 Firm 4 1.45 2.36 IlFirm 5 Firm 6 Firm 7 1.72 2.15 2.40 2.64 2.42 Firm 8 3.03 Firm 9 3.24 2.30 Firm 10 3.53 3. Based on the calculated PBV, identify whether Firm 3, 4, 8, 10 are undervalued or overvalued. Fill in the blanks in the following table. (Note: type either "undervalued" or "overvalued") Firms Valuation (Undervalued/Overvalued) Firm 3 Firm 4 Firm 8 Firm 10 4. Complete the following sentence based on your analysis by filling in the blanks. Firm and are less than their fundamental value (i.e., the predicted PBV). Thus, you should make (select "buy" or "sell") recommendation. Question 12 40 points Save Answer To compare across in a sector, you are looking to price-to-book value ratio. Given the relationship between price-to-book value (PBV) ratios and return on equity (ROE), you are now about to value of integrated oil firms using a regression analysis. To run the regression analysis, you collect the following table which reports the PBV ratios, and ROES. Integrated Oil Firms Price-to-Book Value (PBV) Ratio Return on Equity (ROE) Firm 1 0.54 7.4796 Firm 2 0.64 -4.8396 Firm 3 0.95 6.2896 Firm 4 1.45 10.3396 | Firm 5 1.72 13.9696 Firm 6 2.15 16.4496 Firm 7 2.40 14.4996 IlFirm 8 3.03 15.6996 Firm 9 3.24 13.4396 Firm 10 3.53 10.67% 1. Regress of PBV on ROE and you will have the following results. Fill in the blanks (Note: Round to the nearest tenth. e.g. 3.452 => 3.5) Coefficients It-Statistics Intercepts 1.5 ROE 2.5 2. Using the estimated regression model from the above result, calculate the respective predicted PBV multiples and fill in the blanks (Note: Round to the nearest hundredth. e.g. 3.452 => 3.45) Integrated Oil Firms Price-to-Book Value (PBV) Ratio Predicted PBV multiples Firm 1 0.54 1.64 Firm 2 0.64 0.26 Firm 3 0.95 Firm 4 1.45 Firm 5 1.72 2.36 2.64 Firm 6 2.15 nin 2. Using the estimated regression model from the above result, calculate the respective predicted PBV multiples and fill in the blanks (Note: Round to the nearest hundredth. e.g. 3.452 => 3.45) Integrated Oil Firms Price-to-Book Value (PBV) Ratio Predicted PBV multiples Firm 1 0.54 1.64 Firm 2 0.64 0.26 Firm 3 0.95 Firm 4 1.45 2.36 IlFirm 5 Firm 6 Firm 7 1.72 2.15 2.40 2.64 2.42 Firm 8 3.03 Firm 9 3.24 2.30 Firm 10 3.53 3. Based on the calculated PBV, identify whether Firm 3, 4, 8, 10 are undervalued or overvalued. Fill in the blanks in the following table. (Note: type either "undervalued" or "overvalued") Firms Valuation (Undervalued/Overvalued) Firm 3 Firm 4 Firm 8 Firm 10 4. Complete the following sentence based on your analysis by filling in the blanks. Firm and are less than their fundamental value (i.e., the predicted PBV). Thus, you should make (select "buy" or "sell") recommendation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts