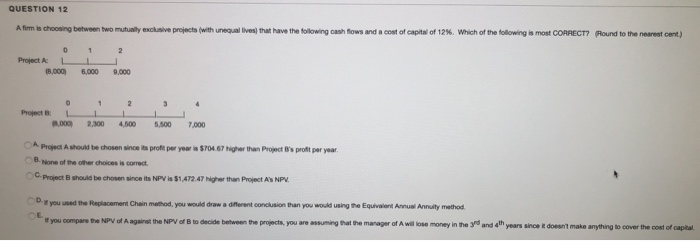

Question: QUESTION 12 Afimis choosing between two mutually exclusive projects with unequal lives that have the following cash flows and a cost of capital of 12%.

QUESTION 12 Afimis choosing between two mutually exclusive projects with unequal lives that have the following cash flows and a cost of capital of 12%. Which of the following is most CORRECT? Round to the nearest cent) 3.000 .000 .000 .000 2,300 4.500 5.500 7.000 A Project Ashot be chosen profit pery 70467 h er than Project's profit per year Project should be cho since its NPV is $1.472.47 t h Project As NPL you used the Replacement Chain method, you would drww a different conclusion than you would using the Equivalent Annual Annuity method you compare the NPV of Again the NPV of B to decide between the projects, you are assuming that the manager of Awilone money in the yeand o years since it doesn't make anything to cover the cost of capital

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts