Question: question 12 please show work. also do you half the recieved dividend income? Arrowhead Corporation had Sales of $12,769,670 last year. The firm's costs of

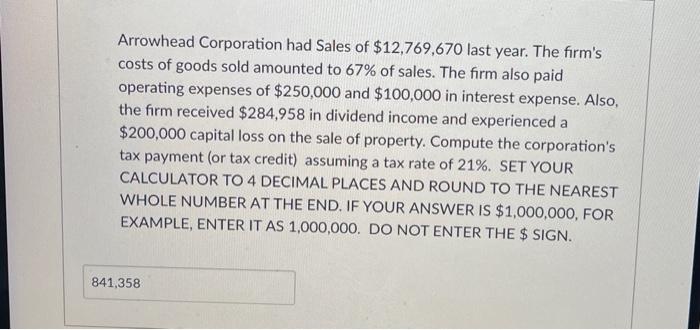

Arrowhead Corporation had Sales of $12,769,670 last year. The firm's costs of goods sold amounted to 67% of sales. The firm also paid operating expenses of $250,000 and $100,000 in interest expense. Also, the firm received $284,958 in dividend income and experienced a $200,000 capital loss on the sale of property. Compute the corporation's tax payment (or tax credit) assuming a tax rate of 21%. SET YOUR CALCULATOR TO 4 DECIMAL PLACES AND ROUND TO THE NEAREST WHOLE NUMBER AT THE END. IF YOUR ANSWER IS $1,000,000, FOR EXAMPLE, ENTER IT AS 1,000,000. DO NOT ENTER THE $ SIGN. 841,358

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts