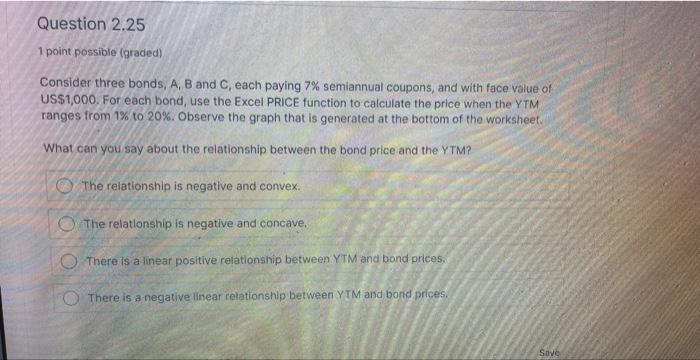

Question: Question 2.25 1 point possible (graded) Consider three bonds, A, B and C, each paying 7% semiannual coupons, and with face value of US$1,000.

Question 2.25 1 point possible (graded) Consider three bonds, A, B and C, each paying 7% semiannual coupons, and with face value of US$1,000. For each bond, use the Excel PRICE function to calculate the price when the YTM ranges from 1% to 20%. Observe the graph that is generated at the bottom of the worksheet. What can you say about the relationship between the bond price and the YTM? The relationship is negative and convex. The relationship is negative and concave. There is a linear positive relationship between YTM and bond prices. There is a negative linear relationship between YTM and bond prices. Save

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts