Question: QUESTION 12 Use the information for the question below. Kinston Industries has come up with a new mountain bike prototype and is ready to go

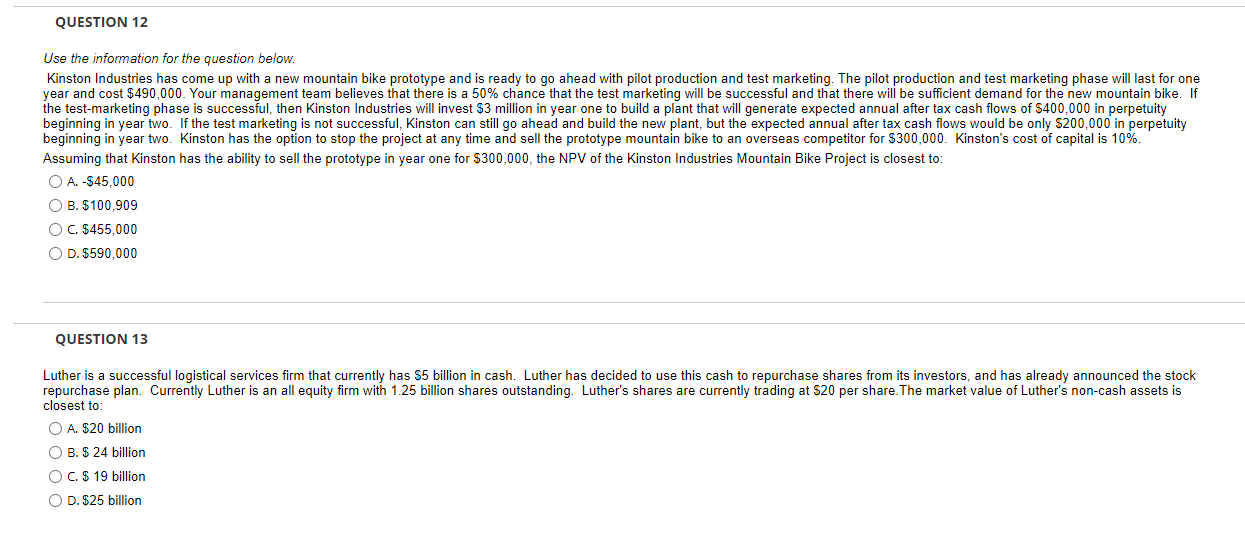

QUESTION 12 Use the information for the question below. Kinston Industries has come up with a new mountain bike prototype and is ready to go ahead with pilot production and test marketing. The pilot production and test marketing phase will last for one year and cost $490,000. Your management team believes that there is a 50% chance that the test marketing will be successful and that there will be sufficient demand for the new mountain bike. If the test-marketing phase is successful, then Kinston Industries will invest $3 million in year one to build a plant that will generate expected annual after tax cash flows of $400,000 in perpetuity beginning in year two. If the test marketing is not successful, Kinston can still go ahead and build the new plant, but the expected annual after tax cash flows would be only $200,000 in perpetuity beginning in year two. Kinston has the option to stop the project at any time and sell the prototype mountain bike to an overseas competitor for $300,000. Kinston's cost of capital is 10%. Assuming that Kinston has the ability to sell the prototype in year one $300,000, the NPV of the Kinston Industries Mountain Bike Project is closest to: O A. -$45,000 O B. $100,909 O C. $455,000 O D. $590,000 QUESTION 13 Luther is a successful logistical services firm that currently has $5 billion in cash. Luther has decided to use this cash to repurchase shares from its investors, and has already announced the stock repurchase plan. Currently Luther is an all equity firm with 1.25 billion shares outstanding. Luther's shares are currently trading at $20 per share. The market value of Luther's non-cash assets is closest to O A. $20 billion O B. $ 24 billion O C. $ 19 billion O D. $25 billion

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts