Question: Question 13 10 points: STRAIGHT LINE DEPRECIATION (note: this is the same asset information as before) On May 1, 2020 Rats Be Gone, Inc purchased

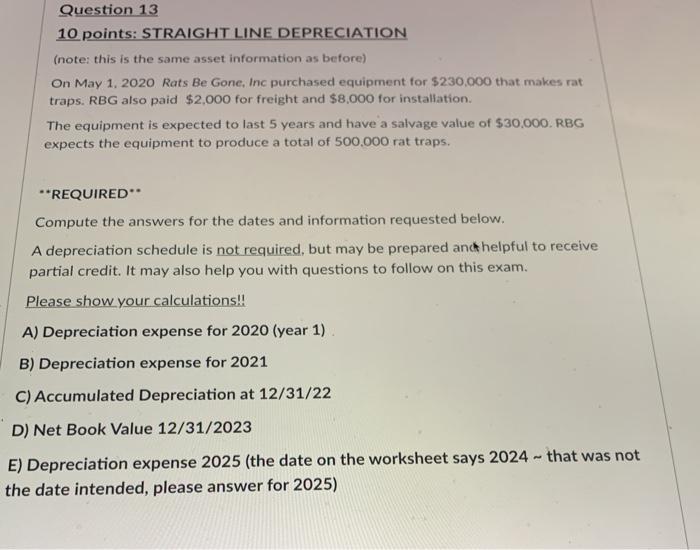

Question 13 10 points: STRAIGHT LINE DEPRECIATION (note: this is the same asset information as before) On May 1, 2020 Rats Be Gone, Inc purchased equipment for $230,000 that makes rat traps. RBG also paid $2,000 for freight and $8,000 for installation The equipment is expected to last 5 years and have a salvage value of $30,000. RBG expects the equipment to produce a total of 500,000 rat traps. **REQUIRED Compute the answers for the dates and information requested below. A depreciation schedule is not required, but may be prepared and helpful to receive partial credit. It may also help you with questions to follow on this exam. Please show your calculations!! A) Depreciation expense for 2020 (year 1) B) Depreciation expense for 2021 C) Accumulated Depreciation at 12/31/22 D) Net Book Value 12/31/2023 E) Depreciation expense 2025 (the date on the worksheet says 2024 - that was not the date intended, please answer for 2025)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts