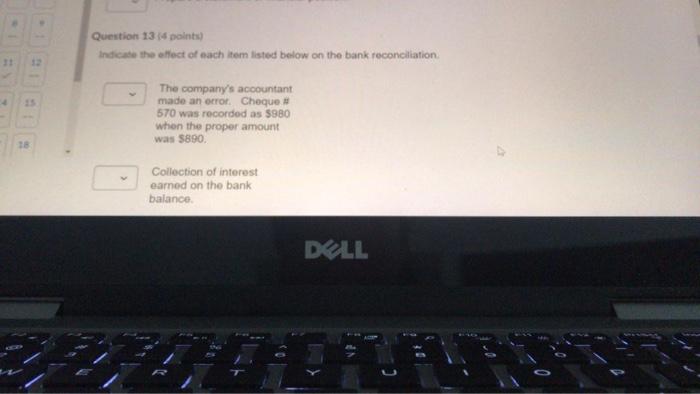

Question: Question 13 14 points) Indicate the effect of each item listed below on the bank reconciliation The company's accountant made an error. Chaque 570 was

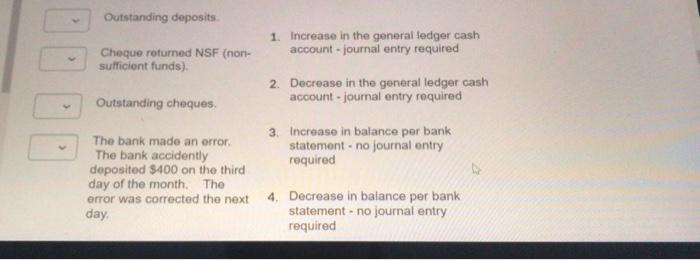

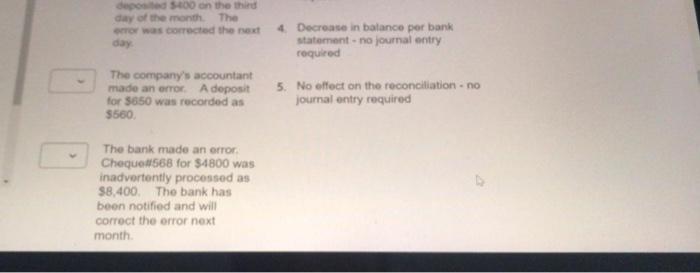

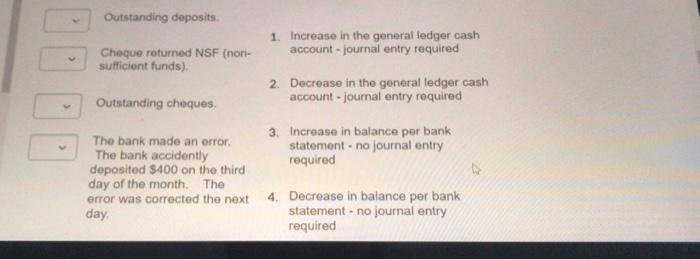

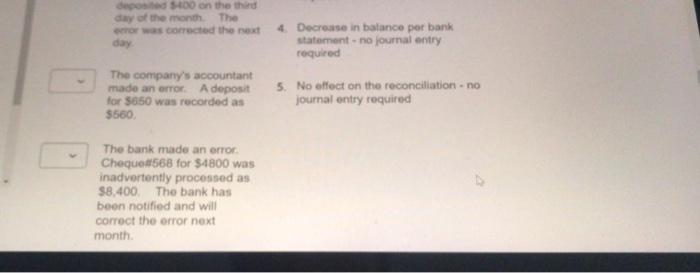

Question 13 14 points) Indicate the effect of each item listed below on the bank reconciliation The company's accountant made an error. Chaque 570 was recorded as 5980 when the proper amount was 8890 TE Collection of interest eamed on the bank balance DELL Outstanding deposits 1. Increase in the general ledger cash account - journal entry required Cheque returned NSF (non- sufficient funds) 2. Decrease in the general ledger cash account - journal entry required Outstanding cheques 3. Increase in balance per bank statement - no journal entry required The bank made an error The bank accidently deposited $400 on the third day of the month. The error was corrected the next day 4. Decrease in balance per bank statement - no journal entry required depo 5400 on the third day of the month The or was corrected the next day 4 Decrease in balanco por bank statement - no journal entry required The company's accountant made an error A deposit for $650 was recorded as 5560 5. No effect on the reconciliation - no journal entry required The bank made an error Cheque568 for $4800 was inadvertently processed as 58.400. The bank has been notified and will correct the orror next month Outstanding deposits 1. Increase in the general ledger cash account - journal entry required Cheque returned NSF (non- sufficient funds) 2. Decrease in the general ledger cash account - journal entry required Outstanding cheques 3. Increase in balance per bank statement - no journal entry required The bank made an error The bank accidently deposited $400 on the third day of the month. The error was corrected the next day 4. Decrease in balance per bank statement - no journal entry required de 500 on the third day of the month The or corrected the next day 4. Decrease in balance por bank statement - no journal entry required The company's accountant made an error. A deposit for $650 was recorded as $560 5. No effect on the reconciliation - no journal entry required The bank made an error Chequo#568 for $4800 was inadvertently processed as 58.400. The bank has been notified and will correct the orror next month

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts