Question: Question 13 14 points Save Answer (Lecture 8 - Stock Valuation) ABC Corp. has 200 million shares outstanding. Analysts expect the firm fo have earnings

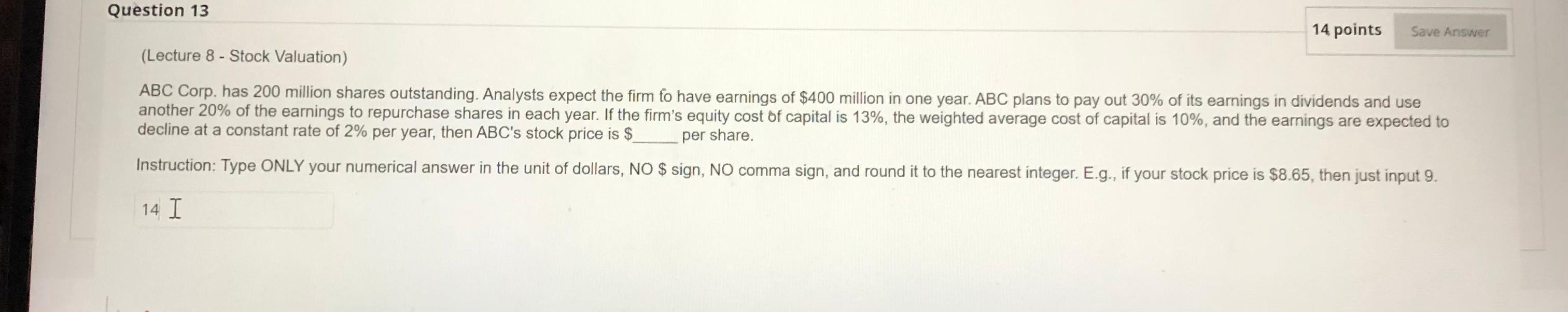

Question 13 14 points Save Answer (Lecture 8 - Stock Valuation) ABC Corp. has 200 million shares outstanding. Analysts expect the firm fo have earnings of $400 million in one year. ABC plans to pay out 30% of its earnings in dividends and use another 20% of the earnings to repurchase shares in each year. If the firm's equity cost of capital is 13%, the weighted average cost of capital is 10%, and the earnings are expected to decline at a constant rate of 2% per year, then ABC's stock price is $ per share. Instruction: Type ONLY your numerical answer in the unit of dollars, NO $ sign, NO comma sign, and round it to the nearest integer. E.g., if your stock price is $8.65, then just input 9. 14

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts