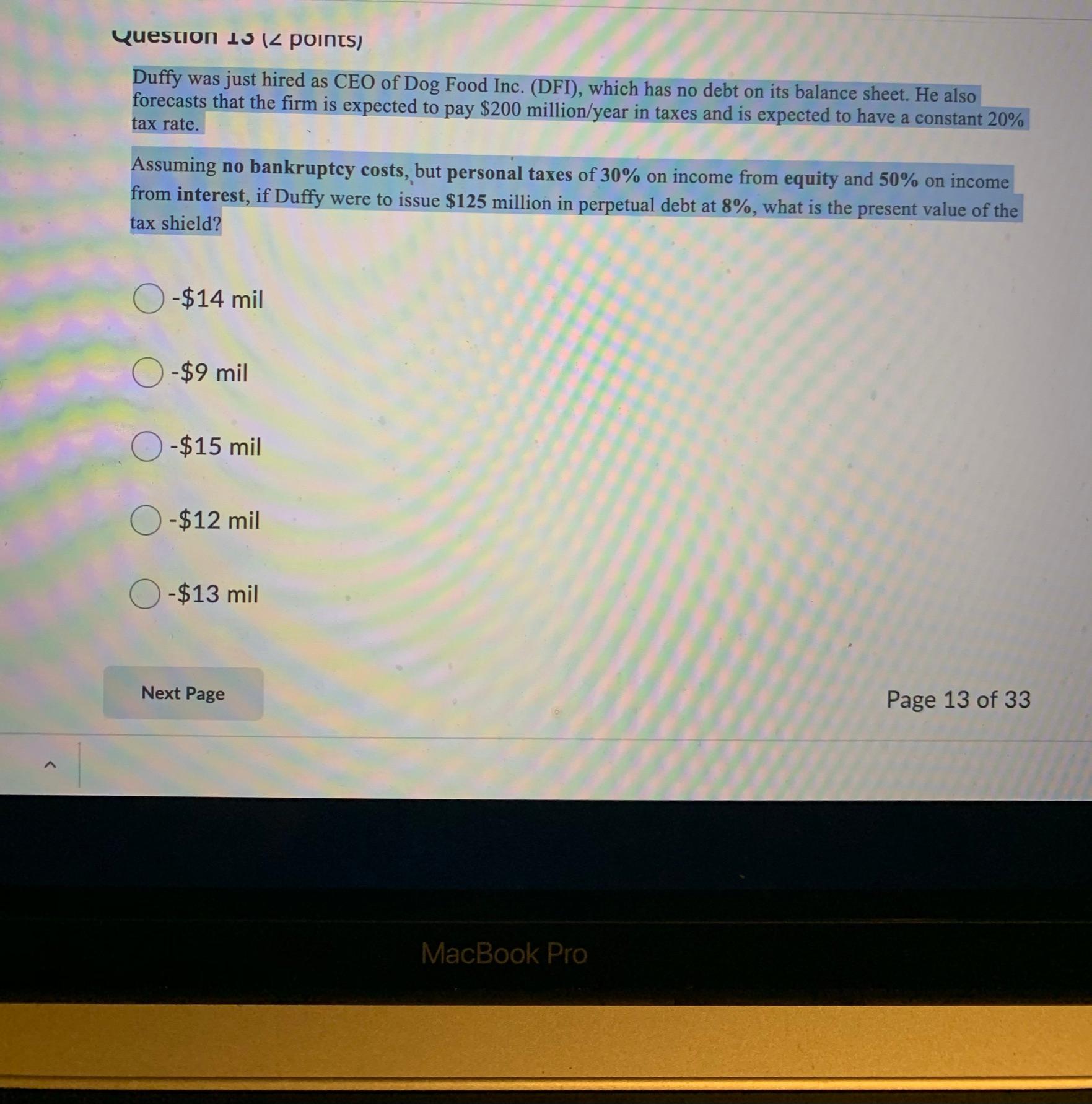

Question: Question 13 (2 points) Duffy was just hired as CEO of Dog Food Inc. (DFI), which has no debt on its balance sheet. He also

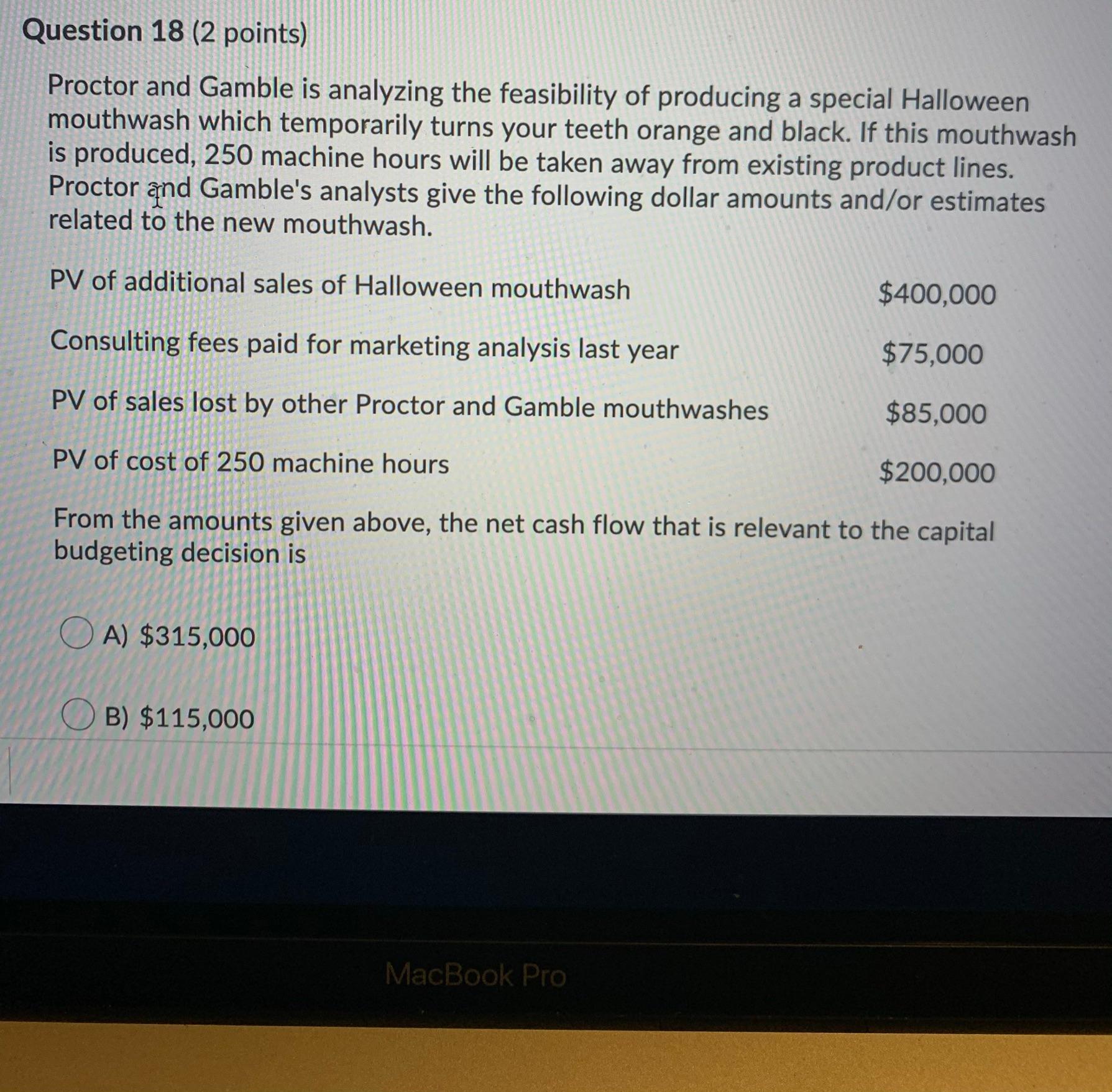

Question 13 (2 points) Duffy was just hired as CEO of Dog Food Inc. (DFI), which has no debt on its balance sheet. He also forecasts that the firm is expected to pay $200 million/year in taxes and is expected to have a constant 20% tax rate. Assuming no bankruptcy costs, but personal taxes of 30% on income from equity and 50% on income from interest, if Duffy were to issue $125 million in perpetual debt at 8%, what is the present value of the tax shield? 0-$14 mil O-$9 mil -$15 mil 0-$12 mil -$13 mil Next Page Page 13 of 33 MacBook Pro Question 18 (2 points) Proctor and Gamble is analyzing the feasibility of producing a special Halloween mouthwash which temporarily turns your teeth orange and black. If this mouthwash is produced, 250 machine hours will be taken away from existing product lines. Proctor and Gamble's analysts give the following dollar amounts and/or estimates related to the new mouthwash. PV of additional sales of Halloween mouthwash $400,000 Consulting fees paid for marketing analysis last year $75,000 PV of sales lost by other Proctor and Gamble mouthwashes $85,000 PV of cost of 250 machine hours $200,000 From the amounts given above, the net cash flow that is relevant to the capital budgeting decision is O A) $315,000 B) $115,000 MacBook Pro

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts