Question: Question 13 (3 points) Use the following table Stock Table YTD 52 - WEEK Div VOL NET Yld %Chg Hi LO Stock/SYM) DIV PE 100s|Close

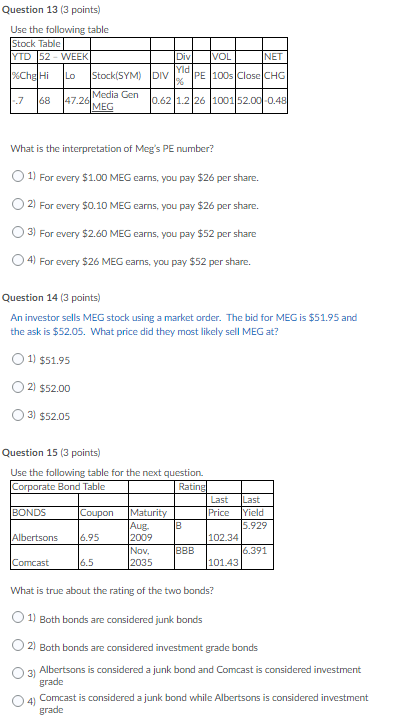

Question 13 (3 points) Use the following table Stock Table YTD 52 - WEEK Div VOL NET Yld %Chg Hi LO Stock/SYM) DIV PE 100s|Close CHG 1.7 68 Media Gen 47.26 MEG 0.621.226 1001 52.00 -0.48 What is the interpretation of Meg's PE number? 1) For every $1.00 MEG earns, you pay $26 per share. 2) For every $0.10 MEG earns, you pay $26 per share. 0 3) For every $2.60 MEG earns, you pay $52 per share 4) For every $26 MEG earns, you pay $52 per share. Question 14 (3 points) An investor sells MEG stock using a market order. The bid for MEG is $51.95 and the ask is $52.05. What price did they most likely sell MEG at? 1) $51.95 21 $52.00 3) $52.05 Question 15 (3 points) Last Use the following table for the next question. Corporate Bond Table Rating Last BONDS Coupon Maturity Price Yield Aug B 15.929 Albertsons 16.95 2009 102 34 Nov, BBB 6.391 Comcast 16.5 2035 101.43 What is true about the rating of the two bonds? 1) Both bonds are considered junk bonds 2) Both bonds are considered investment grade bonds 3) Albertsons is considered a junk bond and Comcast is considered investment grade 4 Comcast is considered a junk bond while Albertsons is considered investment grade

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts