Question: Question 13 (3 points) You have two options for a loan on your new boat. Loan #1 has a stated APR of 5.5% with an

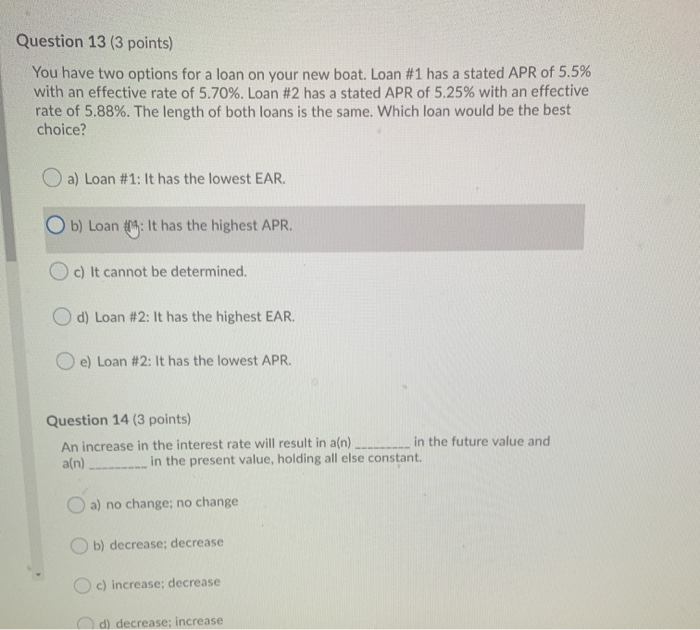

Question 13 (3 points) You have two options for a loan on your new boat. Loan #1 has a stated APR of 5.5% with an effective rate of 5.70%. Loan #2 has a stated APR of 5.25% with an effective rate of 5.88%. The length of both loans is the same. Which loan would be the best choice? a) Loan #1: It has the lowest EAR. Ob) Loan 19: It has the highest APR. Oc) It cannot be determined. d) Loan #2: It has the highest EAR. O e) Loan #2: It has the lowest APR. Question 14 (3 points) An increase in the interest rate will result in a(n) ...... in the future value and an). ...in the present value, holding all else constant. a) no change; no change b) decrease; decrease Oc) increase; decrease d) decrease; increase

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts