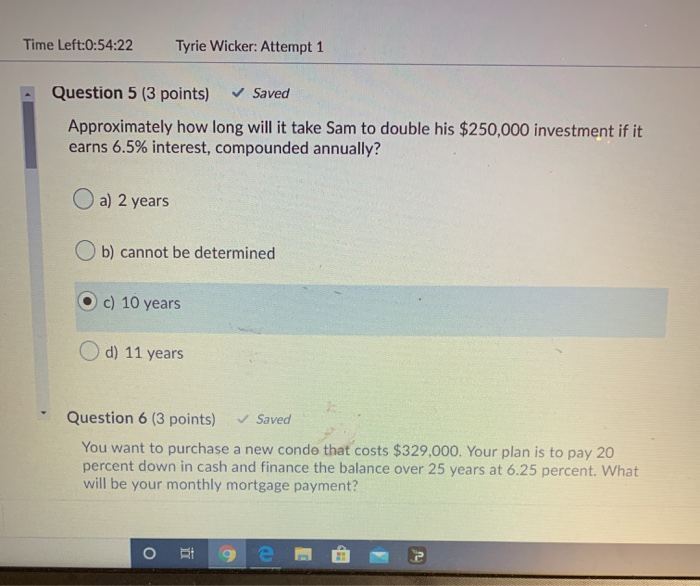

Question: Time Left:0:54:22 Tyrie Wicker: Attempt 1 Question 5 (3 points) Saved Approximately how long will it take Sam to double his $250,000 investment if it

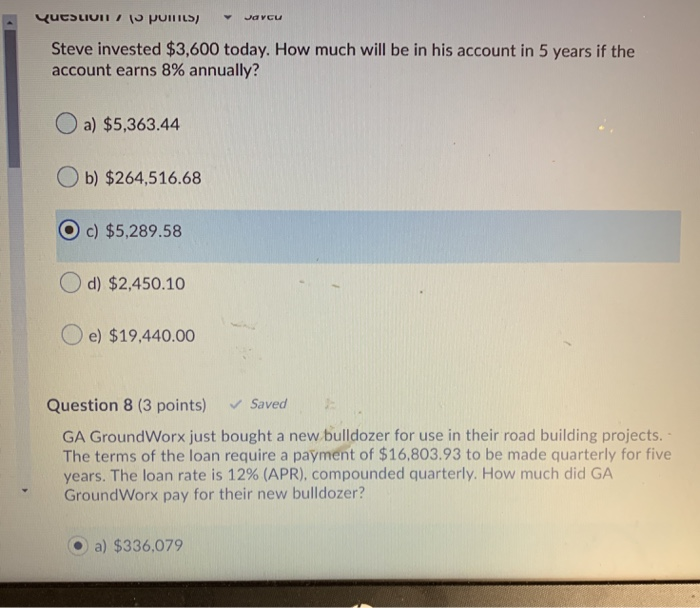

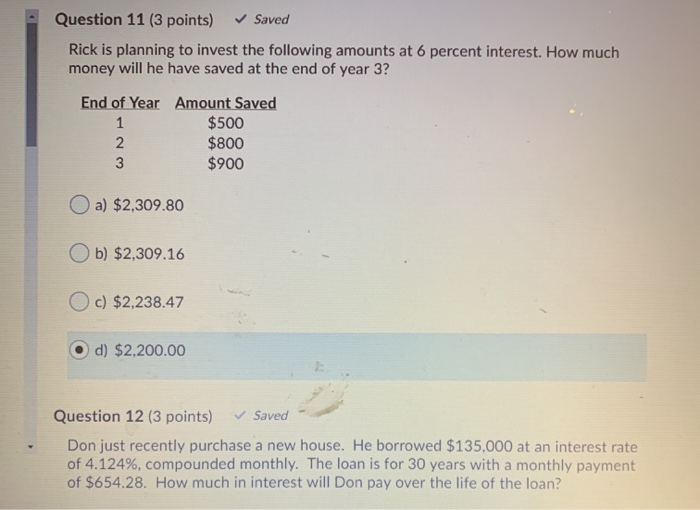

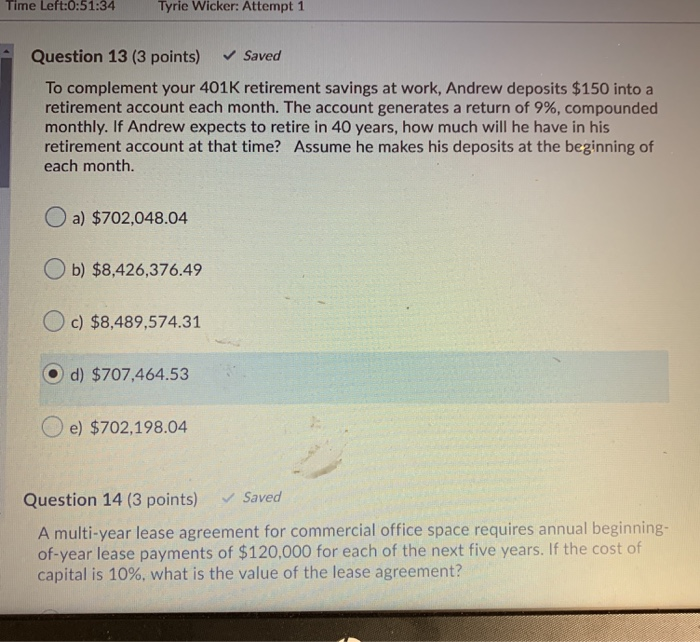

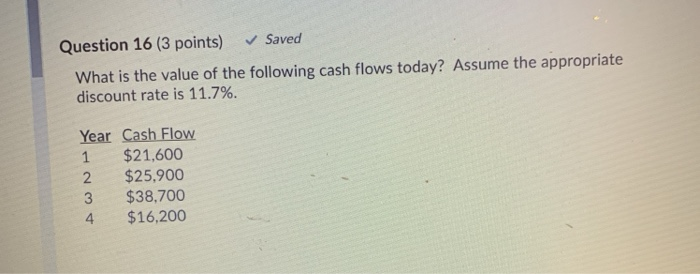

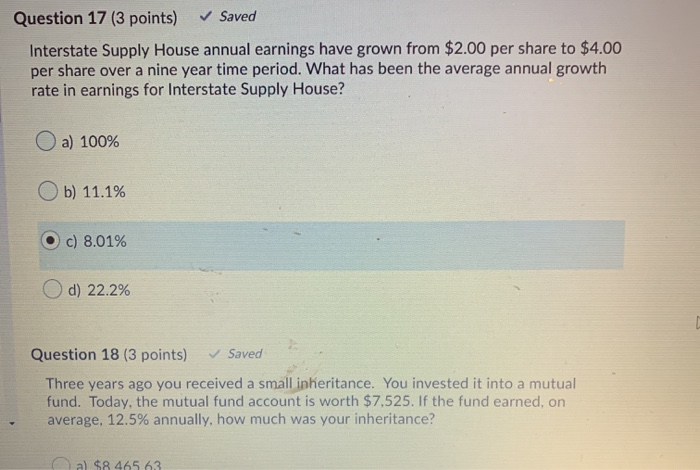

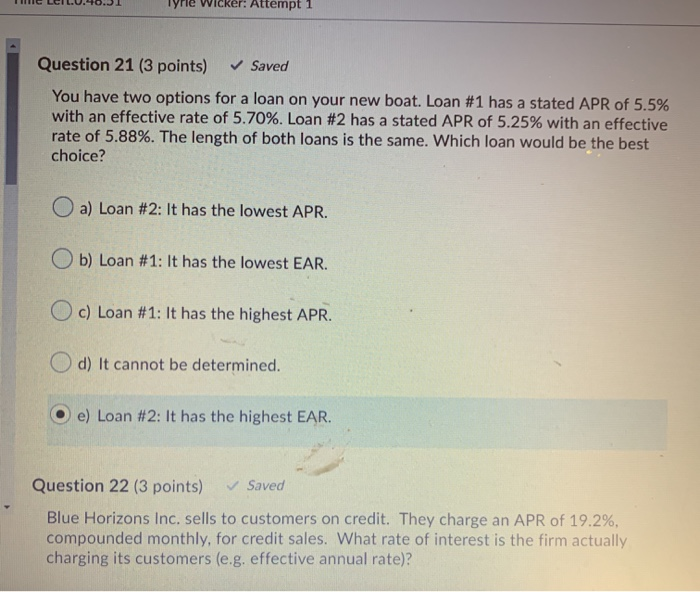

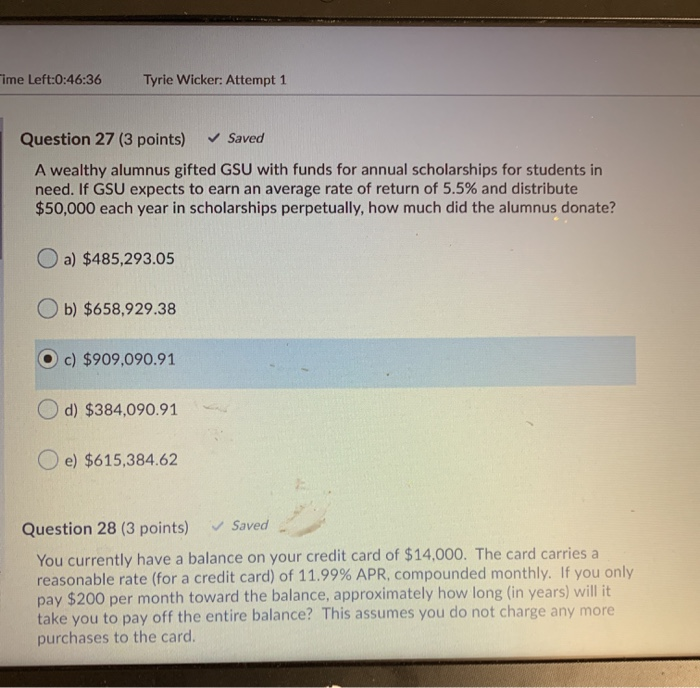

Time Left:0:54:22 Tyrie Wicker: Attempt 1 Question 5 (3 points) Saved Approximately how long will it take Sam to double his $250,000 investment if it earns 6.5% interest, compounded annually? Oa) 2 years Ob) cannot be determined Oc) 10 years Od) 11 years Question 6 (3 points) Saved You want to purchase a new conde that costs $329,000. Your plan is to pay 20 percent down in cash and finance the balance over 25 years at 6.25 percent. What will be your monthly mortgage payment? Question polic5) Javcu Steve invested $3,600 today. How much will be in his account in 5 years if the account earns 8% annually? a) $5,363.44 Ob) $264,516.68 O c) $5,289.58 d) $2,450.10 Oe) $19,440.00 Question 8 (3 points) Saved GA GroundWorx just bought a new bulldozer for use in their road building projects. - The terms of the loan require a payment of $16,803.93 to be made quarterly for five years. The loan rate is 12% (APR), compounded quarterly. How much did GA GroundWorx pay for their new bulldozer? a) $336,079 Question 11 (3 points) Saved Rick is planning to invest the following amounts at 6 percent interest. How much money will he have saved at the end of year 3? End of Year Amount Saved $500 $800 $900 NR a) $2,309.80 Ob) $2,309.16 Oc) $2,238.47 d) $2,200.00 Question 12 (3 points) Saved Don just recently purchase a new house. He borrowed $135,000 at an interest rate of 4.124%, compounded monthly. The loan is for 30 years with a monthly payment of $654.28. How much in interest will Don pay over the life of the loan? Time Left:0:51:34 Tyrie Wicker: Attempt 1 Question 13 (3 points) Saved To complement your 401K retirement savings at work, Andrew deposits $150 into a retirement account each month. The account generates a return of 9%, compounded monthly. If Andrew expects to retire in 40 years, how much will he have in his retirement account at that time? Assume he makes his deposits at the beginning of each month. O a) $702,048.04 Ob) $8,426,376.49 Oc) $8,489,574.31 O d) $707,464.53 Oe) $702,198.04 Question 14 (3 points) Saved A multi-year lease agreement for commercial office space requires annual beginning. of-year lease payments of $120,000 for each of the next five years. If the cost of capital is 10%, what is the value of the lease agreement? Question 16 (3 points) Saved What is the value of the following cash flows today? Assume the appropriate discount rate is 11.7%. Year Cash Flow $21,600 $25.900 $38,700 $16,200 Question 17 (3 points) Saved Interstate Supply House annual earnings have grown from $2.00 per share to $4.00 per share over a nine year time period. What has been the average annual growth rate in earnings for Interstate Supply House? a) 100% Ob) 11.1% Oc) 8.01% d) 22.2% Question 18 (3 points) Saved Three years ago you received a small inheritance. You invested it into a mutual fund. Today, the mutual fund account is worth $7.525. If the fund earned, on average. 12.5% annually, how much was your inheritance? al SA 445 63 GEGE.TOJI ryne vicker: Attempt 1 Question 21 (3 points) Saved You have two options for a loan on your new boat. Loan #1 has a stated APR of 5.5% with an effective rate of 5.70%. Loan #2 has a stated APR of 5.25% with an effective rate of 5.88%. The length of both loans is the same. Which loan would be the best choice? a) Loan #2: It has the lowest APR. b) Loan #1: It has the lowest EAR. Oc) Loan #1: It has the highest APR. d) It cannot be determined. O e) Loan #2: It has the highest EAR. Question 22 (3 points) Saved Blue Horizons Inc. sells to customers on credit. They charge an APR of 19.2%. compounded monthly, for credit sales. What rate of interest is the firm actually charging its customers (e.g. effective annual rate)? ime Left:0:46:36 Tyrie Wicker: Attempt 1 Question 27 (3 points) Saved A wealthy alumnus gifted GSU with funds for annual scholarships for students in need. If GSU expects to earn an average rate of return of 5.5% and distribute $50,000 each year in scholarships perpetually, how much did the alumnus donate? a) $485,293.05 Ob) $658,929.38 O c) $909,090.91 d) $384.090.91 Oe) $615,384.62 Question 28 (3 points) Saved You currently have a balance on your credit card of $14,000. The card carries a reasonable rate (for a credit card) of 11.99% APR, compounded monthly. If you only pay $200 per month toward the balance, approximately how long (in years) will it take you to pay off the entire balance? This assumes you do not charge any more purchases to the card

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts