Question: Question 13 3 pts You must evaluate a proposal to buy a new milling machine. The base price is $108,000, and shipping and installation costs

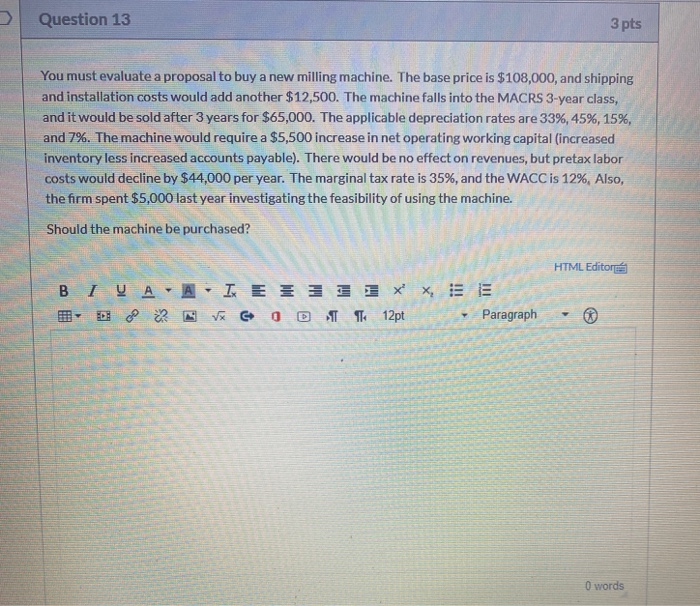

Question 13 3 pts You must evaluate a proposal to buy a new milling machine. The base price is $108,000, and shipping and installation costs would add another $12,500. The machine falls into the MACRS 3-year class, and it would be sold after 3 years for $65,000. The applicable depreciation rates are 33%, 45%, 15%, and 7%. The machine would require a $5,500 increase in net operating working capital (increased inventory less increased accounts payable). There would be no effect on revenues, but pretax labor costs would decline by $44,000 per year. The marginal tax rate is 35%, and the WACC is 12%, Also, the firm spent $5,000 last year investigating the feasibility of using the machine. Should the machine be purchased? HTML Editore BIYA - A - I E II 1XX, SE VX 60 DI 12pt Paragraph O words

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts