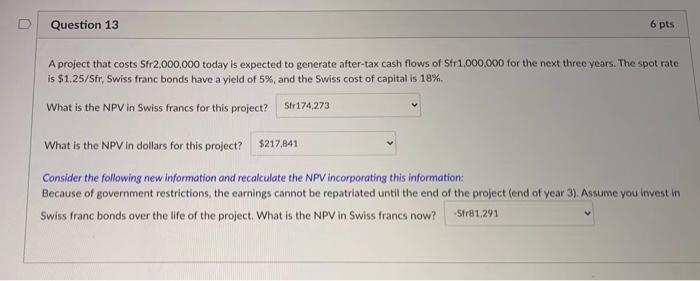

Question: Question 13 6 pts Str1,000,000 for the next three years. The spot rate A project that costs Sfr2,000,000 today is expected to generate after-tax cash

Question 13 6 pts Str1,000,000 for the next three years. The spot rate A project that costs Sfr2,000,000 today is expected to generate after-tax cash flows is $1.25/Sfr, Swiss franc bonds have a yield of 5%, and the Swiss cost of capital is 18% What is the NPV in Swiss francs for this project? Str174,273 What is the NPV in dollars for this project? $217,841 Consider the following new information and recalculate the NPV incorporating this information: Because of government restrictions, the earnings cannot be repatriated until the end of the project lend of year 3). Assume you invest in Swiss franc bonds over the life of the project. What is the NPV in Swiss francs now? Stre1.291

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts