Question: Question 13 and 14 T ULES, cu seconds. Question Completion Status: QUESTION 13 A call option exists on British pounds with an exercise price of

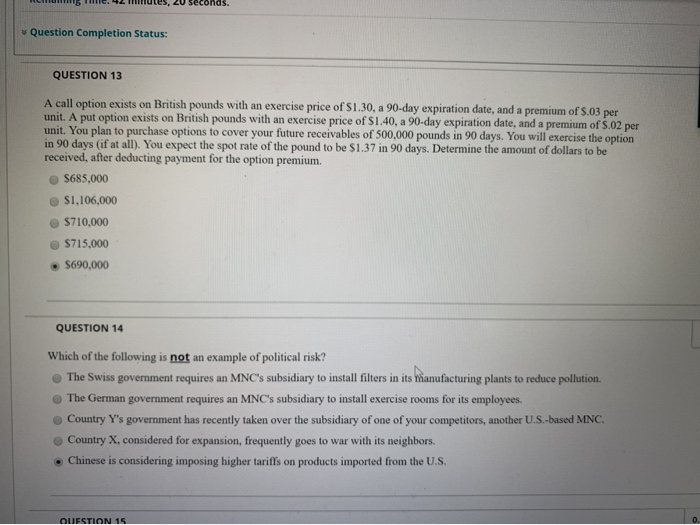

T ULES, cu seconds. Question Completion Status: QUESTION 13 A call option exists on British pounds with an exercise price of $1.30, a 90-day expiration date, and a premium of $.03 per unit. A put option exists on British pounds with an exercise price of $1.40, a 90-day expiration date, and a premium of 5.02 per unit. You plan to purchase options to cover your future receivables of 500,000 pounds in 90 days. You will exercise the option in 90 days (if at all). You expect the spot rate of the pound to be $1.37 in 90 days. Determine the amount of dollars to be received, after deducting payment for the option premium. S685,000 $1,106,000 S710,000 $715,000 $690,000 QUESTION 14 Which of the following is not an example of political risk? The Swiss government requires an MNC's subsidiary to install filters in its Manufacturing plants to reduce pollution The German government requires an MNC's subsidiary to install exercise rooms for its employees. Country Y's government has recently taken over the subsidiary of one of your competitors, another U.S.-based MNC Country X, considered for expansion, frequently goes to war with its neighbors. Chinese is considering imposing higher tariffs on products imported from the U.S. LECTION

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts