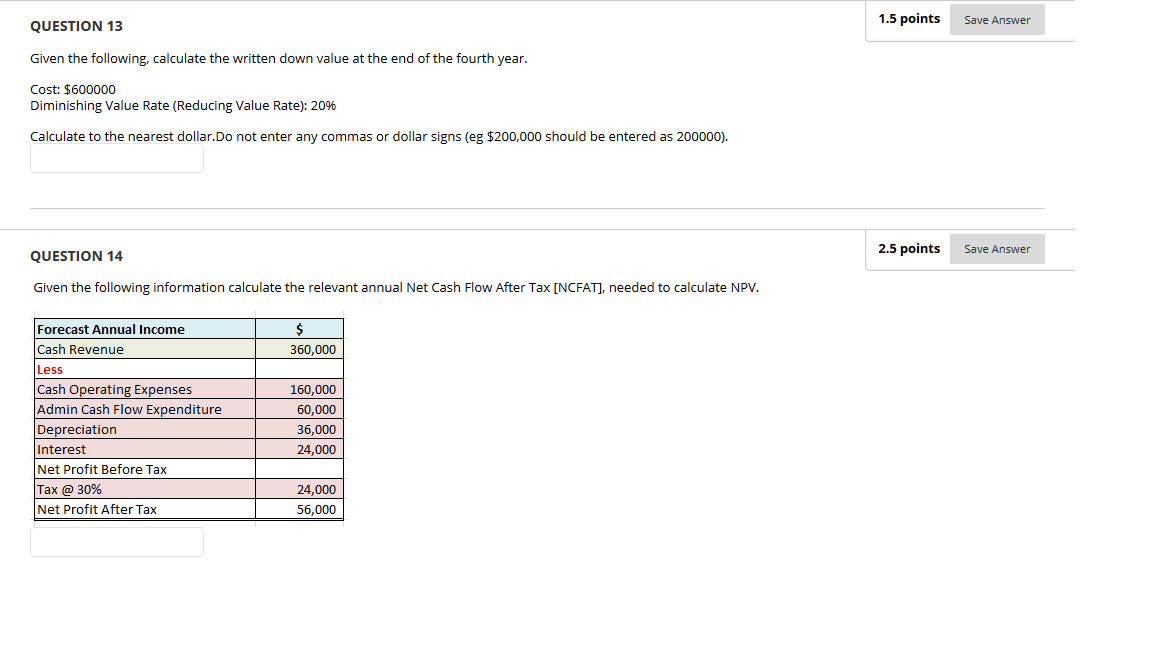

Question: QUESTION 13 Given the followingr calculate the written down value at the end of the fourth year. Cost: $600000 Diminishing Value Rate (Reducing Value Rate):

QUESTION 13 Given the followingr calculate the written down value at the end of the fourth year. Cost: $600000 Diminishing Value Rate (Reducing Value Rate): 20% Calculate to the nearest dollar.Do not enter anyr commas or dollar signs {eg $200,000 should be entered as 200000). QUESTION 14 Given the following information calculate the relevant annual Net Cash Flow After Tax [NCFA'I], needed to calculate NW. Forecast Annual Income 5 Cash Revenue 360,000 Less Cash Operating Expenses 160,000 Admin Cash Flow Expenditure 60,000 Depreciation 36,000 Interest 24,000 Net Profit Before Tax Tax @ 30% 24,000 Net Profit After Tax 56,000 1.5 points 2.5 points Save Answer Save

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts