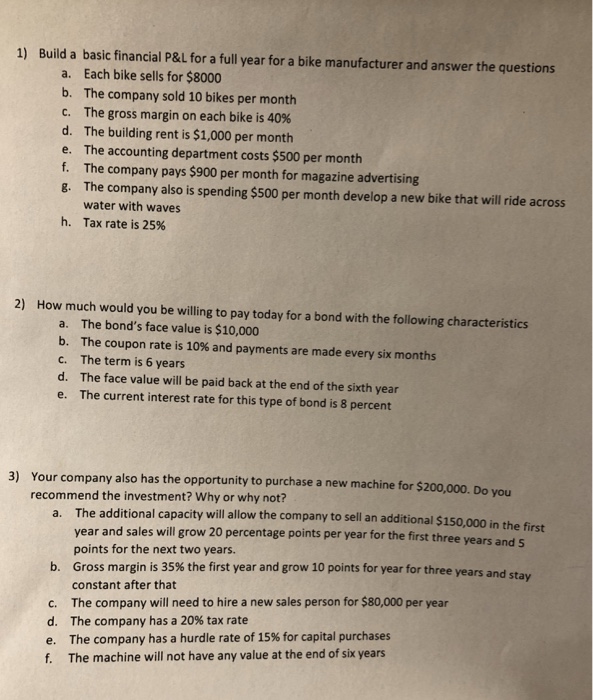

Question: Question 1-3 is related 1) Build a basic financial P&L for a full year for a bike manufacturer and answer the questions a. Each bike

1) Build a basic financial P&L for a full year for a bike manufacturer and answer the questions a. Each bike sells for $8000 b. The company sold 10 bikes per month C. The gross margin on each bike is 40% d. The building rent is $1,000 per month e. The accounting department costs $500 per month f. The company pays $900 per month for magazine advertising g. The company also is spending $500 per month develop a new bike that will ride across water with waves Tax rate is 25% h, 2) How much would you be willing to pay today for a bond with the following characteristics a. b, c. d. e. The bond's face value is $10,000 The coupon rate is 10% and payments are made every six months The term is 6 years The face value will be paid back at the end of the sixth year The current interest rate for this type of bond is 8 percent Your company also has the opportunity to purchase a new machine for $200,000. Do you recommend the investment? Why or why not? 3) The additional capacity will allow the company to sell an additional $150,000 in the first year and sales will grow 20 percentage points per year for the first three ye points for the next two years. Gross margin is 35% the first year and grow 10 points for year for three years a constant after that The company will need to hire a new sales person for $80,000 per year The company has a 20% tax rate The company has a hurdle rate of 15% for capital purchases The machine will not have any value at the end of six years a. ars and 5 b. nd stay c. d. e. f

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts