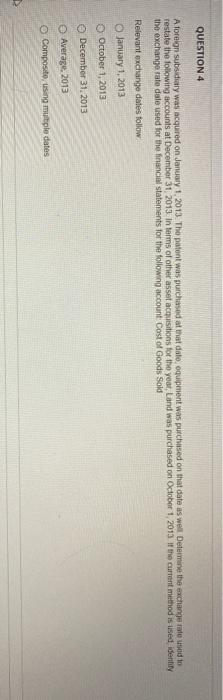

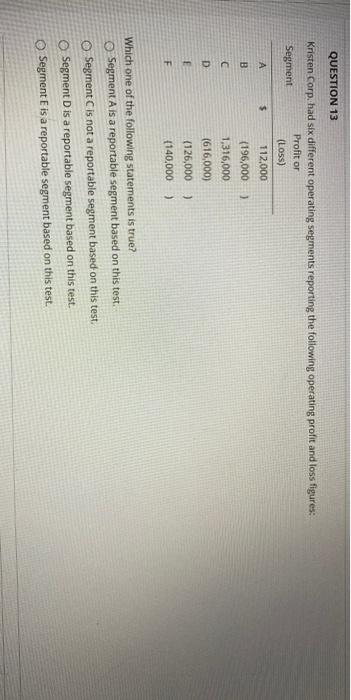

Question: QUESTION 13 Kristen Corp. had six different operating segments reporting the following operating profit and loss figures: Profit or Segment (Loss) $ 112,000 B (196,000

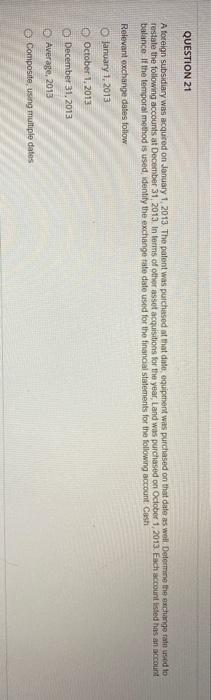

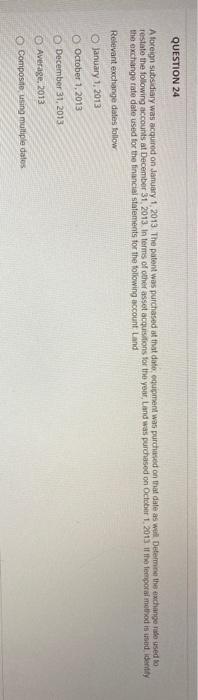

QUESTION 13 Kristen Corp. had six different operating segments reporting the following operating profit and loss figures: Profit or Segment (Loss) $ 112,000 B (196,000 1,316,000 D (616,000) (126,000) 140,000 ) Which one of the following statements is true? Segment A is a reportable segment based on this test. Segment is not a reportable segment based on this test Segment Dis a reportable segment based on this test. Segment is a reportable segment based on this test. QUESTION 21 A foreign subsidiary was acquired on January 1, 2013. The patent was purchased at that date equipment was purchased on that date as well Determine the exchange ratin used to restate the following accounts at December 31, 2013. In terms of other asset acquisitions for the year Land was purchased on October 1, 2013. Each account listed as an account balance if the temporal method is used, identify the exchange rate date used for the financial statements for the following account Cash Relevant exchange dates follow January 1, 2013 October 1, 2013 @ December 31, 2013 Average, 2013 Composite, using multiple datos QUESTION 24 A foreign subsidiary was acquired on January 1, 2013 The patent was purchased at that dato, equipment was purchased on that date as well Determine the exchange rate used to restate the following accounts at December 31, 2013. In terms of other asset acquisitions for the year, and was purchased on October 1, 2013 in the temporal method is used identity the exchange rate date used for the financial statements for the following account Land Relevant exchange dates follow January 1, 2013 O October 1, 2013 December 31, 2013 Average. 2013 Composite using multiple datos

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts