Question: Question 13 only would be justinegit Ul the trailing P/E, P/B, and P/S multiples required rate of return in Part A and current values of

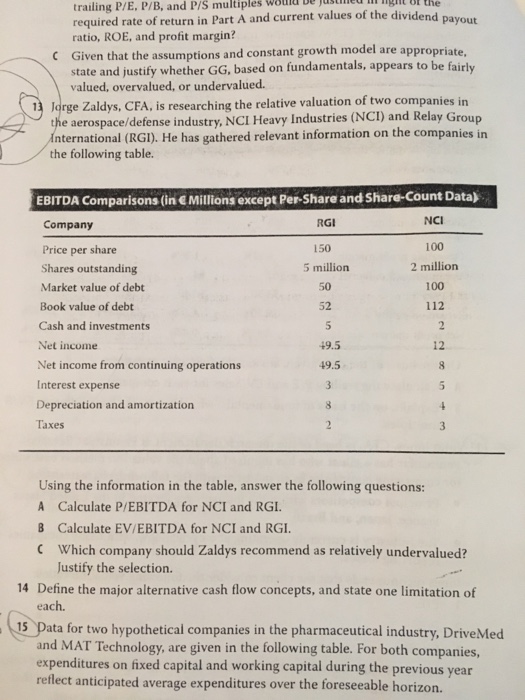

would be justinegit Ul the trailing P/E, P/B, and P/S multiples required rate of return in Part A and current values of the dividend payout ratio, ROE, and profit margin? are appropriate Given that the assumptions and constant growth model state and justify whether GG, based on fundamentals, appears to be fairky valued, overvalued, or undervalued. 1 Jorge Zaldys, CFA, is researching the relative valuation of two companies in e aerospace/defense industry, NCI Heavy Industries (NCI) and Relay Group International (RGI). He has gathered relevant information on the companies in the following table. EBITDA Comparisons (in Millions except Per-Share and Share-Count Data) RGI 150 5 million 50 52 NCI 100 2 million 100 112 Company Price per share Shares outstanding Market value of debt Book value of debt Cash and investments Net income Net income from continuing operations Interest expense Depreciation and amortization Taxes 2 49.5 12 49.5 Using the information in the table, answer the following questions: A Calculate P/EBITDA for NCI and RGI Calculate EV/EBITDA for NCI and RGI. Which company should Zaldys recommend as relatively undervalued? Justify the selection. 8 C 14 Define the major alternative cash flow concepts, and state one limitation of each. 15 Data for two hypothetical companies in the pharmaceutical industry, Drive Med and MAT Technology, are given in the following table. For both companies expenditures on fixed capital and working capital during the previous year reflect anticipated average expenditures over the foreseeable horizon

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts