Question: Question 3 Your uncle understands that you are taking Security Analysis in Multimedia University. He wants to know whether he should invest in Happy and

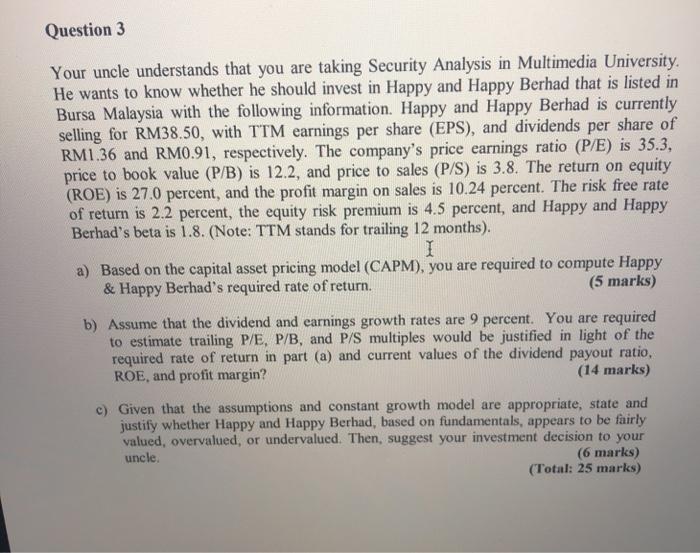

Question 3 Your uncle understands that you are taking Security Analysis in Multimedia University. He wants to know whether he should invest in Happy and Happy Berhad that is listed in Bursa Malaysia with the following information. Happy and Happy Berhad is currently selling for RM38.50, with TTM earnings per share (EPS), and dividends per share of RM1.36 and RM0.91, respectively. The company's price earnings ratio (P/E) is 35.3, price to book value (P/B) is 12.2, and price to sales (P/S) is 3.8. The return on equity (ROE) is 27.0 percent, and the profit margin on sales is 10.24 percent. The risk free rate of return is 2.2 percent, the equity risk premium is 4.5 percent, and Happy and Happy Berhad's beta is 1.8. (Note: TTM stands for trailing 12 months). I a) Based on the capital asset pricing model (CAPM), you are required to compute Happy & Happy Berhad's required rate of return. (5 marks) b) Assume that the dividend and earnings growth rates are 9 percent. You are required to estimate trailing P/E, P/B, and P/S multiples would be justified in light of the required rate of return in part (a) and current values of the dividend payout ratio, ROE, and profit margin? (14 marks) c) Given that the assumptions and constant growth model are appropriate, state and justify whether Happy and Happy Berhad, based on fundamentals, appears to be fairly valued, overvalued, or undervalued. Then, suggest your investment decision to your uncle. (6 marks) (Total: 25 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts