Question: Question 131 pts Use the below information to answer questions #13-#15 Mozzie is considering buying a $5,400 electric golf cart to help his workers be

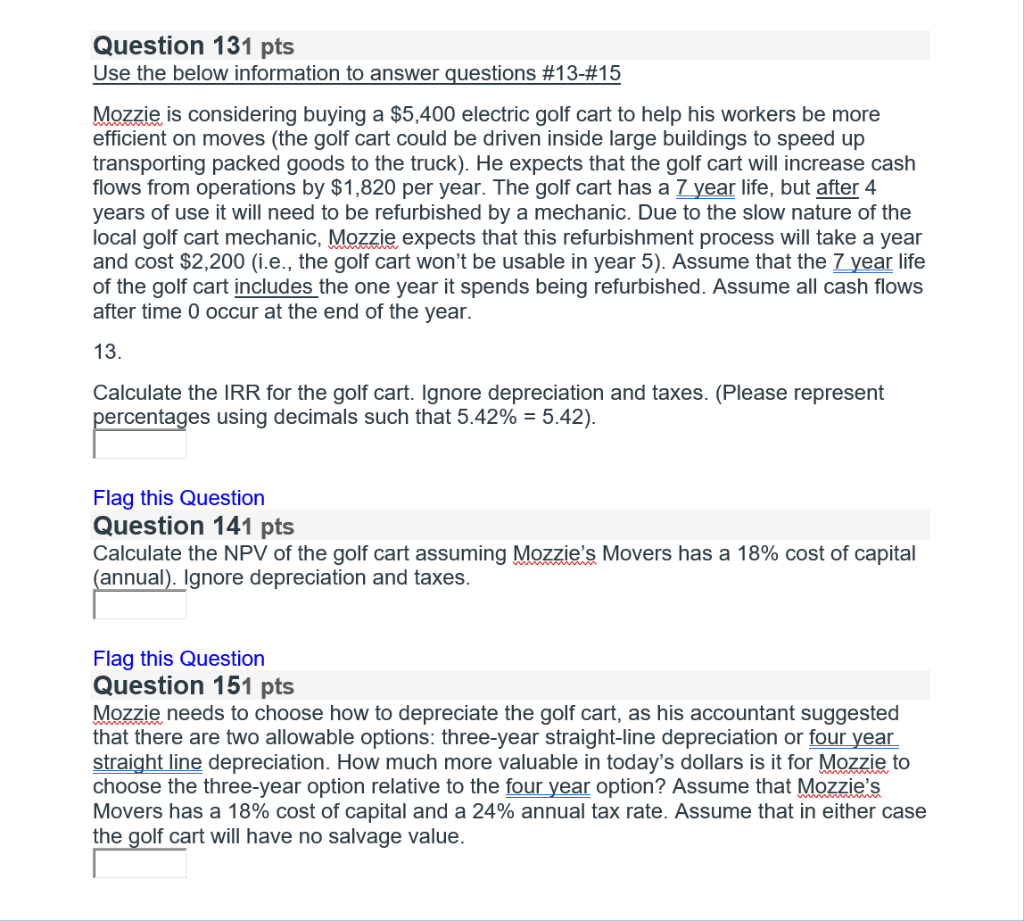

Question 131 pts Use the below information to answer questions #13-#15 Mozzie is considering buying a $5,400 electric golf cart to help his workers be more efficient on moves (the golf cart could be driven inside large buildings to speed up transporting packed goods to the truck). He expects that the golf cart will increase cash flows from operations by $1,820 per year. The golf cart has a 7 year life, but after 4 years of use it will need to be refurbished by a mechanic. Due to the slow nature of the local golf cart mechanic, Mozzie expects that this refurbishment process will take a year and cost $2,200 (i.e., the golf cart won't be usable in year 5). Assume that the 7 year life of the golf cart includes the one year it spends being refurbished. Assume all cash flows after time 0 occur at the end of the year. 13. Calculate the IRR for the golf cart. Ignore depreciation and taxes. (Please represent percentages using decimals such that 5.42% = 5.42). Flag this Question Question 141 pts Calculate the NPV of the golf cart assuming Mozzie's Movers has a 18% cost of capital (annual). Ignore depreciation and taxes. Flag this Question Question 151 pts Mozzie needs to choose how to depreciate the golf cart, as his accountant suggested that there are two allowable options: three-year straight-line depreciation or four year straight line depreciation. How much more valuable in today's dollars is it for Mozzie to choose the three-year option relative to the four year option? Assume that Mozzie's Movers has a 18% cost of capital and a 24% annual tax rate. Assume that in either case the golf cart will have no salvage value. Question 131 pts Use the below information to answer questions #13-#15 Mozzie is considering buying a $5,400 electric golf cart to help his workers be more efficient on moves (the golf cart could be driven inside large buildings to speed up transporting packed goods to the truck). He expects that the golf cart will increase cash flows from operations by $1,820 per year. The golf cart has a 7 year life, but after 4 years of use it will need to be refurbished by a mechanic. Due to the slow nature of the local golf cart mechanic, Mozzie expects that this refurbishment process will take a year and cost $2,200 (i.e., the golf cart won't be usable in year 5). Assume that the 7 year life of the golf cart includes the one year it spends being refurbished. Assume all cash flows after time 0 occur at the end of the year. 13. Calculate the IRR for the golf cart. Ignore depreciation and taxes. (Please represent percentages using decimals such that 5.42% = 5.42). Flag this Question Question 141 pts Calculate the NPV of the golf cart assuming Mozzie's Movers has a 18% cost of capital (annual). Ignore depreciation and taxes. Flag this Question Question 151 pts Mozzie needs to choose how to depreciate the golf cart, as his accountant suggested that there are two allowable options: three-year straight-line depreciation or four year straight line depreciation. How much more valuable in today's dollars is it for Mozzie to choose the three-year option relative to the four year option? Assume that Mozzie's Movers has a 18% cost of capital and a 24% annual tax rate. Assume that in either case the golf cart will have no salvage value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts