Question: Question 14 (3.33 points) Consider the exchange rate between New Zealand dollars and British pounds. Assume British inflation rates rise while New Zealand inflation rates

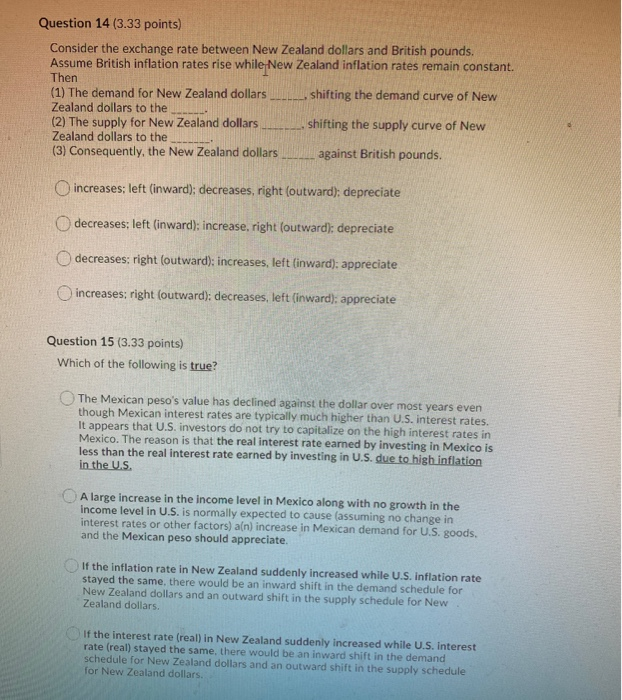

Question 14 (3.33 points) Consider the exchange rate between New Zealand dollars and British pounds. Assume British inflation rates rise while New Zealand inflation rates remain constant. Then (1) The demand for New Zealand dollars ___shifting the demand curve of New Zealand dollars to the (2) The supply for New Zealand dollars shifting the supply curve of New Zealand dollars to the (3) Consequently, the New Zealand dollars . against British pounds. increases; left (inward); decreases, right (outward); depreciate decreases; left (inward): increase, right (outward); depreciate decreases: right outward); increases, left (inward); appreciate increases: right (outward); decreases, left (inward); appreciate Question 15 (3.33 points) Which of the following is true? The Mexican peso's value has declined against the dollar over most years even though Mexican interest rates are typically much higher than U.S. interest rates. It appears that U.S. investors do not try to capitalize on the high interest rates in Mexico. The reason is that the real interest rate earned by investing in Mexico is less than the real interest rate earned by investing in U.S. due to high inflation in the U.S. A large increase in the income level in Mexico along with no growth in the income level in U.S. is normally expected to cause (assuming no change in interest rates or other factors) a[n) increase in Mexican demand for U.S. goods. and the Mexican peso should appreciate. If the inflation rate in New Zealand suddenly increased while U.S. Inflation rate stayed the same, there would be an inward shift in the demand schedule for New Zealand dollars and an outward shift in the supply schedule for New. Zealand dollars. If the interest rate (real) in New Zealand suddenly Increased while U.S. Interest rate (real) stayed the same, there would be an inward shift in the demand schedule for New Zealand dollars and an outward shift in the supply schedule for New Zealand dollars

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts