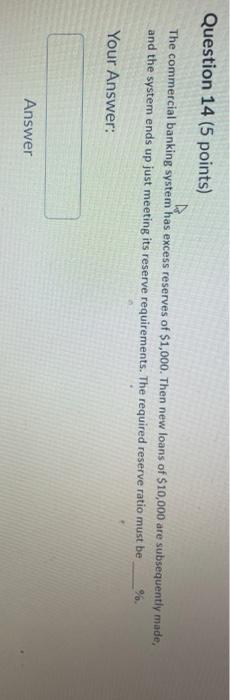

Question: Question 14 (5 points) The commercial banking system has excess reserves of $1,000. Then new loans of $10,000 are subsequently made, and the system ends

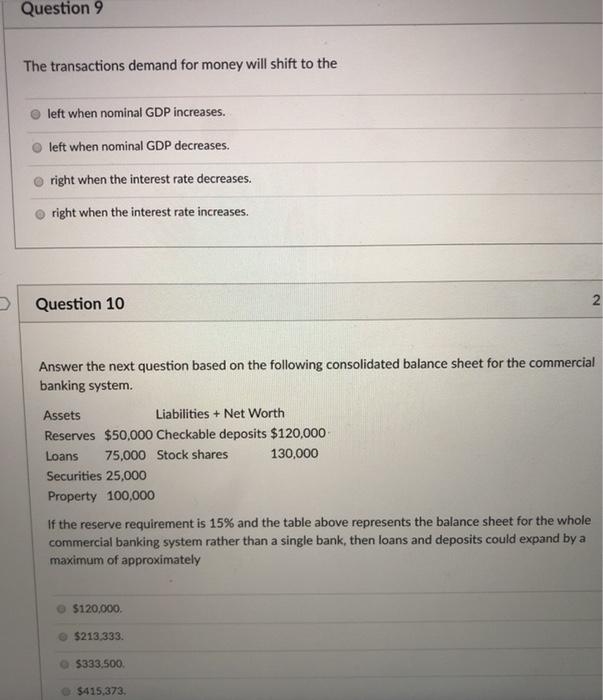

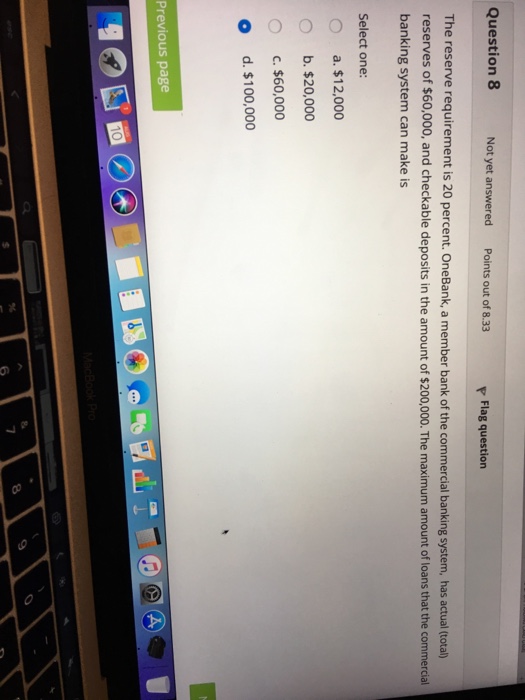

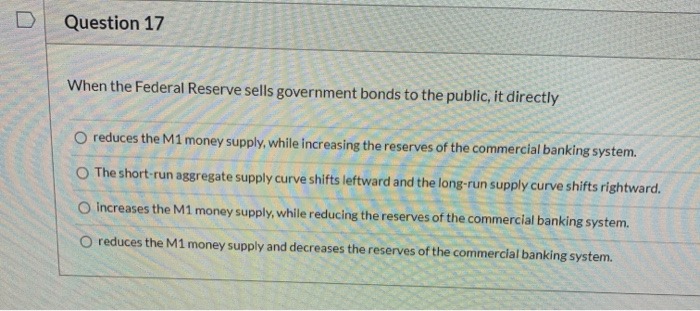

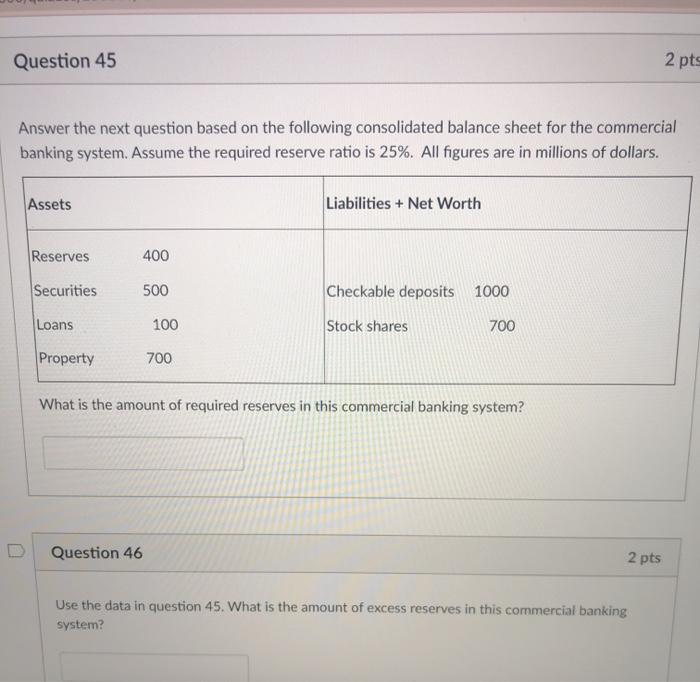

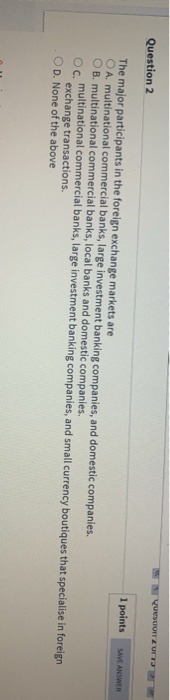

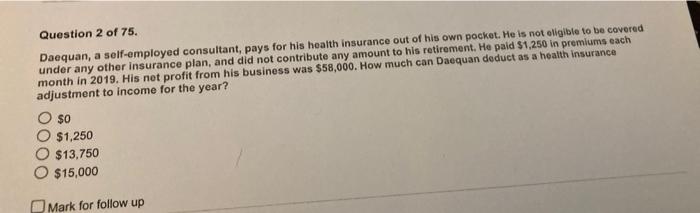

Question 14 (5 points) The commercial banking system has excess reserves of $1,000. Then new loans of $10,000 are subsequently made, and the system ends up just meeting its reserve requirements. The required reserve ratio must be Your Answer: AnswerQuestion 9 The transactions demand for money will shift to the O left when nominal GDP increases. O left when nominal GDP decreases. right when the interest rate decreases. right when the interest rate increases. Question 10 Answer the next question based on the following consolidated balance sheet for the commercial banking system. Assets Liabilities + Net Worth Reserves $50,000 Checkable deposits $120,000 Loans 75,000 Stock shares 130,000 Securities 25,000 Property 100,000 If the reserve requirement is 15% and the table above represents the balance sheet for the whole commercial banking system rather than a single bank, then loans and deposits could expand by a maximum of approximately $120,000. 0 $213.333. @ 5333.500 5415,373.Question 8 Not yet answered Points out of 8.33 Flag question The reserve requirement is 20 percent. OneBank, a member bank of the commercial banking system, has actual (total) reserves of $60,000, and checkable deposits in the amount of $200,000. The maximum amount of loans that the commercial banking system can make is Select one: O a. $12,000 O b. $20,000 O c. $60,000 O d. $100,000 Previous page 4 MacBook ProD Question 17 When the Federal Reserve sells government bonds to the public, it directly O reduces the M1 money supply, while increasing the reserves of the commercial banking system. The short-run aggregate supply curve shifts leftward and the long-run supply curve shifts rightward. O increases the M1 money supply, while reducing the reserves of the commercial banking system. O reduces the M1 money supply and decreases the reserves of the commercial banking system.Question 45 2 pts Answer the next question based on the following consolidated balance sheet for the commercial banking system. Assume the required reserve ratio is 25%. All figures are in millions of dollars. Assets Liabilities + Net Worth Reserves 400 Securities 500 Checkable deposits 1000 Loans 100 Stock shares 700 Property 700 What is the amount of required reserves in this commercial banking system? D Question 46 2 pts Use the data in question 45. What is the amount of excess reserves in this commercial banking system?Question 2 1 points SAW ANSWER The major participants in the foreign exchange markets are QA. multinational commercial banks, large investment banking companies, and domestic companies. OB. multinational commercial banks, local banks and domestic companies. multinational commercial banks, large investment banking companies, and small currency boutiques that specialise in foreign exchange transactions. O D. None of the aboveQuestion 2 of 75. Daequan, a self-employed consultant, pays for his health insurance out of his own pocket. He is not eligible to be covered under any other insurance plan, and did not contribute any amount to his retirement. He paid $1,250 in premiums each month in 2019. His net profit from his business was $58,000. How much can Daequan deduct as a health insurance adjustment to Income for the year? O $0 O $1,250 O $13,750 $15,000 Mark for follow up