Question: Question 14 ABC Ltd is considering two possible projects but can only raise enough funds to proceed with one of them. Investment appraisal techniques have

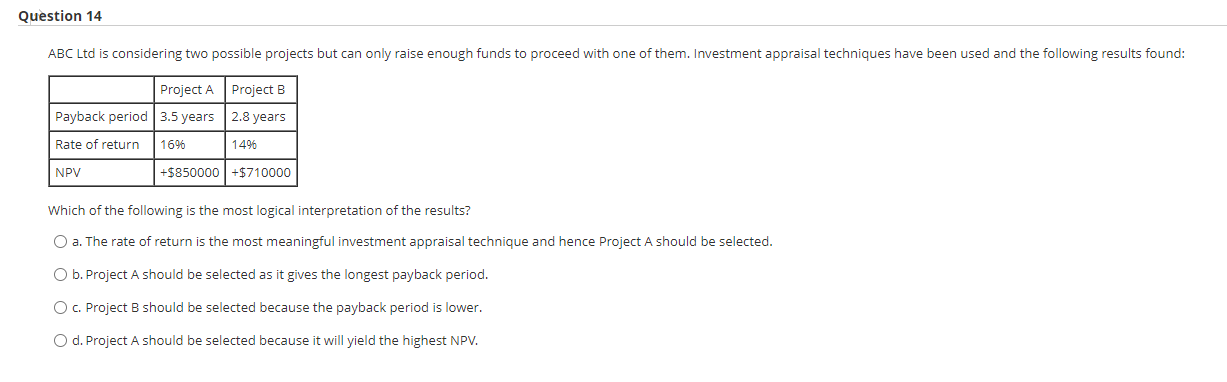

Question 14 ABC Ltd is considering two possible projects but can only raise enough funds to proceed with one of them. Investment appraisal techniques have been used and the following results found: Project A Project B Payback period 3.5 years 2.8 years Rate of return 1696 1496 NPV +$850000 +$710000 Which of the following is the most logical interpretation of the results? O a. The rate of return is the most meaningful investment appraisal technique and hence Project A should be selected. O b. Project A should be selected as it gives the longest payback period. O c. Project B should be selected because the payback period is lower. O d. Project A should be selected because it will yield the highest NPV

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts