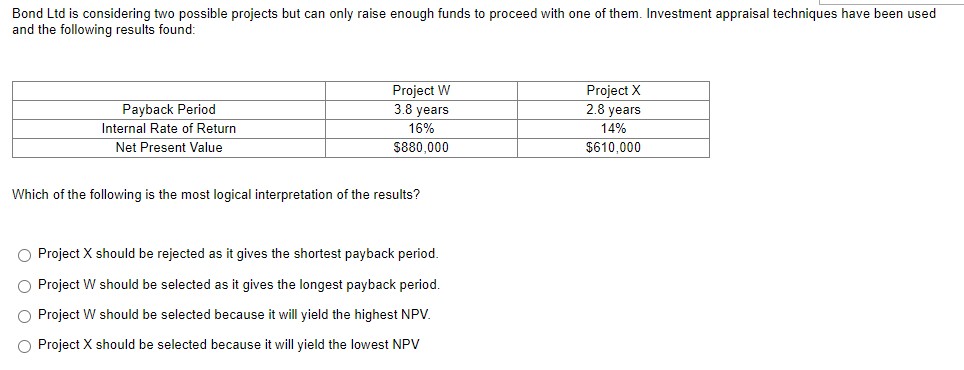

Question: Bond Ltd is considering two possible projects but can only raise enough funds to proceed with one of them. Investment appraisal techniques have been used

Bond Ltd is considering two possible projects but can only raise enough funds to proceed with one of them. Investment appraisal techniques have been used and the following results found: Payback Period Internal Rate of Return Net Present Value Project W 3.8 years 16% $880,000 Which of the following is the most logical interpretation of the results? O Project X should be rejected as it gives the shortest payback period. O Project W should be selected as it gives the longest payback period. O Project W should be selected because it will yield the highest NPV. O Project X should be selected because it will yield the lowest NPV Project X 2.8 years 14% $610,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts