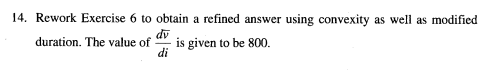

Question: question 14 only. Note: there is a misprint. It should read dv/di = -800 The current price of an annual coupon bond is 100. The

question 14 only. Note: there is a misprint. It should read dv/di = -800

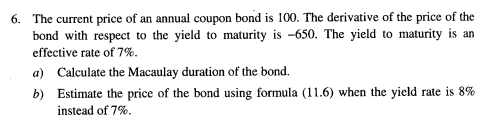

The current price of an annual coupon bond is 100. The derivative of the price of the bond with respect to the yield to maturity is -650. The yield to maturity is an effective rate of 7%. a) Calculate the Macaulay duration of the bond. 6. b) Estimate the price of the bond using formula (11.6) when the yield rate is 8% instead of 7%. 14. Rework Exercise 6 to obtain a refined answer using convexity as well as modified duration. The value of is given to be 800. di The current price of an annual coupon bond is 100. The derivative of the price of the bond with respect to the yield to maturity is -650. The yield to maturity is an effective rate of 7%. a) Calculate the Macaulay duration of the bond. 6. b) Estimate the price of the bond using formula (11.6) when the yield rate is 8% instead of 7%. 14. Rework Exercise 6 to obtain a refined answer using convexity as well as modified duration. The value of is given to be 800. di

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts