Question: QUESTION 14 PART A PART B PART C PART D (Related to Checkpoint 9.1) (Floating-rate loans) The Bensington Glass Company entered into a loan agreement

QUESTION 14

PART A

PART B

PART B

PART C

PART C

PART D

PART D

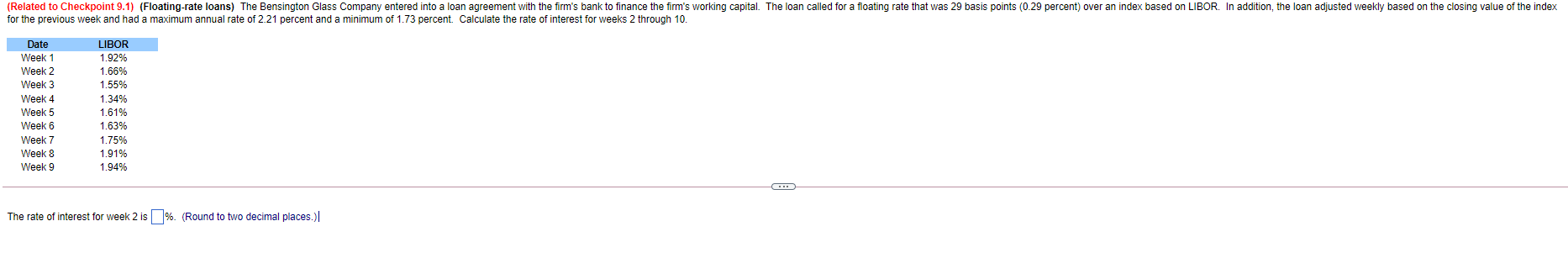

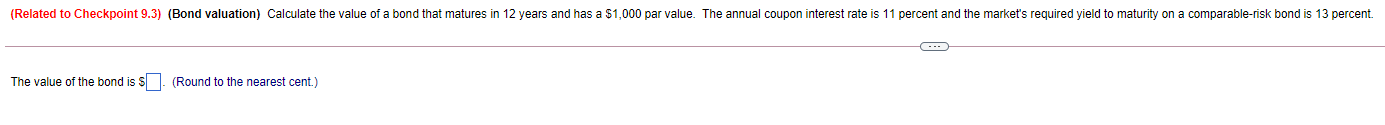

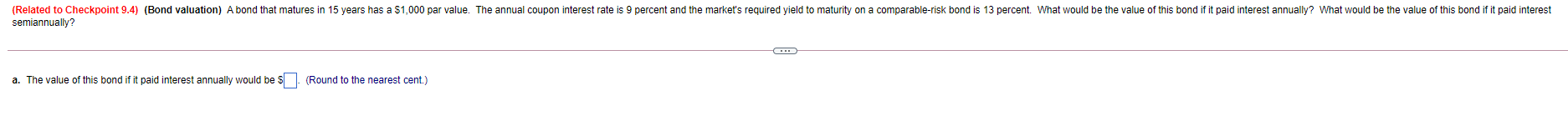

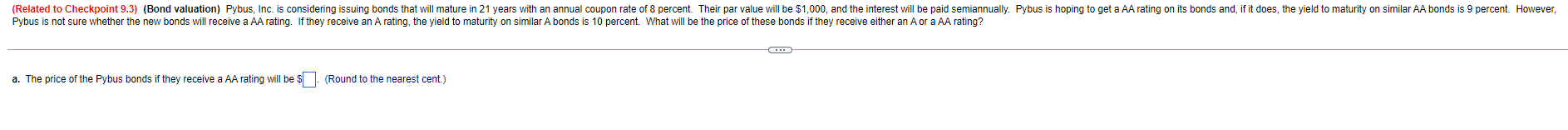

(Related to Checkpoint 9.1) (Floating-rate loans) The Bensington Glass Company entered into a loan agreement with the firm's bank to finance the firm's working capital. The loan called for a floating rate that was 29 basis points (0.29 percent) over an index based on LIBOR. In addition, the loan adjusted weekly based on the closing value of the index for the previous week and had a maximum annual rate of 2.21 percent and a minimum of 1.73 percent. Calculate the rate of interest for weeks 2 through 10. Date Week 1 Week 2 Week 3 Week 4 CON Week 5 Week 6 Week 7 Week 8 Week 9 LIBOR 1.92% 1.66% 1.55% 1.34% w 1.61% 1.63% 1.75% 1.91% 1.94% The rate of interest for week 2 is % (Round to two decimal places.) (Related to Checkpoint 9.3) (Bond valuation) Calculate the value of a bond that matures in 12 years and has a $1,000 par value. The annual coupon interest rate is 11 percent and the market's required yield to maturity on a comparable-risk bond is 13 percent. --- The value of the bond is $. (Round to the nearest cent.) (Related to Checkpoint 9.4) (Bond valuation) A bond that matures in 15 years has a $1,000 par value. The annual coupon interest rate is 9 percent and the market's required yield to maturity on a comparable-risk bond is 13 percent. What would be the value of this bond if it paid interest annually? What would be the value of this bond if it paid interest semiannually? a. The value of this bond if it paid interest annually would be $ (Round to the nearest cent.) (Related to Checkpoint 9.3) (Bond valuation) Pybus, Inc. is considering issuing bonds that will mature in 21 years with an annual coupon rate of 8 percent. Their par value will be $1,000, and the interest will be paid semiannually. Pybus is hoping to get a AA rating on its bonds and, if it does, the yield to maturity on similar AA bonds is 9 percent. However, Pybus is not sure whether the new bonds will receive a AA rating. If they receive an A rating, the yield to maturity on similar A bonds is 10 percent. What will be the price of these bonds if they receive either an A or a AA rating? a. The price of the Pybus bonds if they receive a AA rating will be $. (Round to the nearest cent.) (Related to Checkpoint 9.1) (Floating-rate loans) The Bensington Glass Company entered into a loan agreement with the firm's bank to finance the firm's working capital. The loan called for a floating rate that was 29 basis points (0.29 percent) over an index based on LIBOR. In addition, the loan adjusted weekly based on the closing value of the index for the previous week and had a maximum annual rate of 2.21 percent and a minimum of 1.73 percent. Calculate the rate of interest for weeks 2 through 10. Date Week 1 Week 2 Week 3 Week 4 CON Week 5 Week 6 Week 7 Week 8 Week 9 LIBOR 1.92% 1.66% 1.55% 1.34% w 1.61% 1.63% 1.75% 1.91% 1.94% The rate of interest for week 2 is % (Round to two decimal places.) (Related to Checkpoint 9.3) (Bond valuation) Calculate the value of a bond that matures in 12 years and has a $1,000 par value. The annual coupon interest rate is 11 percent and the market's required yield to maturity on a comparable-risk bond is 13 percent. --- The value of the bond is $. (Round to the nearest cent.) (Related to Checkpoint 9.4) (Bond valuation) A bond that matures in 15 years has a $1,000 par value. The annual coupon interest rate is 9 percent and the market's required yield to maturity on a comparable-risk bond is 13 percent. What would be the value of this bond if it paid interest annually? What would be the value of this bond if it paid interest semiannually? a. The value of this bond if it paid interest annually would be $ (Round to the nearest cent.) (Related to Checkpoint 9.3) (Bond valuation) Pybus, Inc. is considering issuing bonds that will mature in 21 years with an annual coupon rate of 8 percent. Their par value will be $1,000, and the interest will be paid semiannually. Pybus is hoping to get a AA rating on its bonds and, if it does, the yield to maturity on similar AA bonds is 9 percent. However, Pybus is not sure whether the new bonds will receive a AA rating. If they receive an A rating, the yield to maturity on similar A bonds is 10 percent. What will be the price of these bonds if they receive either an A or a AA rating? a. The price of the Pybus bonds if they receive a AA rating will be $. (Round to the nearest cent.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts