Question: QUESTION 14 You can buy some mining hardware for $513 which will be able to mine at 11 THPS (tera hashes per second), and consume

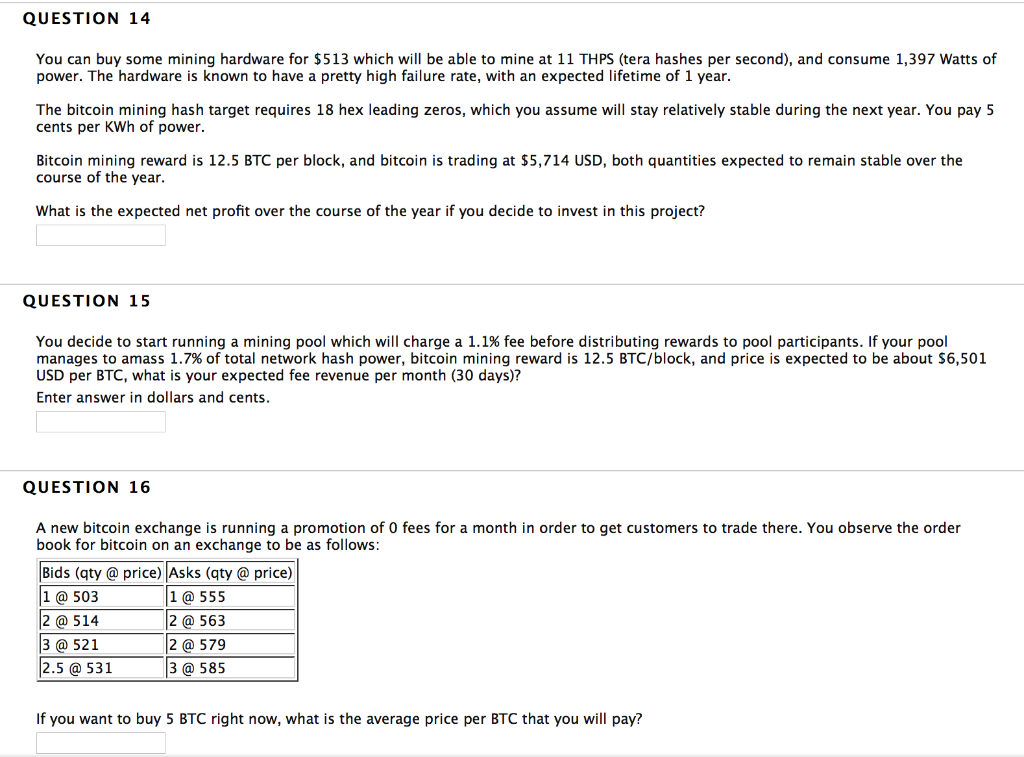

QUESTION 14 You can buy some mining hardware for $513 which will be able to mine at 11 THPS (tera hashes per second), and consume 1,397 Watts of power. The hardware is known to have a pretty high failure rate, with an expected lifetime of 1 year. The bitcoin mining hash target requires 18 hex leading zeros, which you assume will stay relatively stable during the next year. You pay 5 cents per kWh of power. Bitcoin mining reward is 12.5 BTC per block, and bitcoin is trading at $5,714 USD, both quantities expected to remain stable over the course of the year. What is the expected net profit over the course of the year if you decide to invest in this project? QUESTION 15 You decide to start running a mining pool which will charge a 1.1% fee before distributing rewards to pool participants. If your pool manages to amass 1.7% of total network hash power, bitcoin mining reward is 12.5 BTC/block, and price is expected to be about $6,501 USD per BTC, what is your expected fee revenue per month (30 days)? Enter answer in dollars and cents. QUESTION 16 A new bitcoin exchange is running a promotion of O fees for a month in order to get customers to trade there. You observe the order book for bitcoin on an exchange to be as follows: Bids (aty @ price) Asks (qty @ price) 1 @ 503 1 @ 555 2 @ 514 2 @ 563 3 @ 521 2 @ 579 2.5 @ 531 3 @ 585 If you want to buy 5 BTC right now, what is the average price per BTC that you will pay? QUESTION 14 You can buy some mining hardware for $513 which will be able to mine at 11 THPS (tera hashes per second), and consume 1,397 Watts of power. The hardware is known to have a pretty high failure rate, with an expected lifetime of 1 year. The bitcoin mining hash target requires 18 hex leading zeros, which you assume will stay relatively stable during the next year. You pay 5 cents per kWh of power. Bitcoin mining reward is 12.5 BTC per block, and bitcoin is trading at $5,714 USD, both quantities expected to remain stable over the course of the year. What is the expected net profit over the course of the year if you decide to invest in this project? QUESTION 15 You decide to start running a mining pool which will charge a 1.1% fee before distributing rewards to pool participants. If your pool manages to amass 1.7% of total network hash power, bitcoin mining reward is 12.5 BTC/block, and price is expected to be about $6,501 USD per BTC, what is your expected fee revenue per month (30 days)? Enter answer in dollars and cents. QUESTION 16 A new bitcoin exchange is running a promotion of O fees for a month in order to get customers to trade there. You observe the order book for bitcoin on an exchange to be as follows: Bids (aty @ price) Asks (qty @ price) 1 @ 503 1 @ 555 2 @ 514 2 @ 563 3 @ 521 2 @ 579 2.5 @ 531 3 @ 585 If you want to buy 5 BTC right now, what is the average price per BTC that you will pay

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts