Question: Question 14 Your company has compiled the following data which is based on current costs relative to its sources of external capital ie long-term debt,

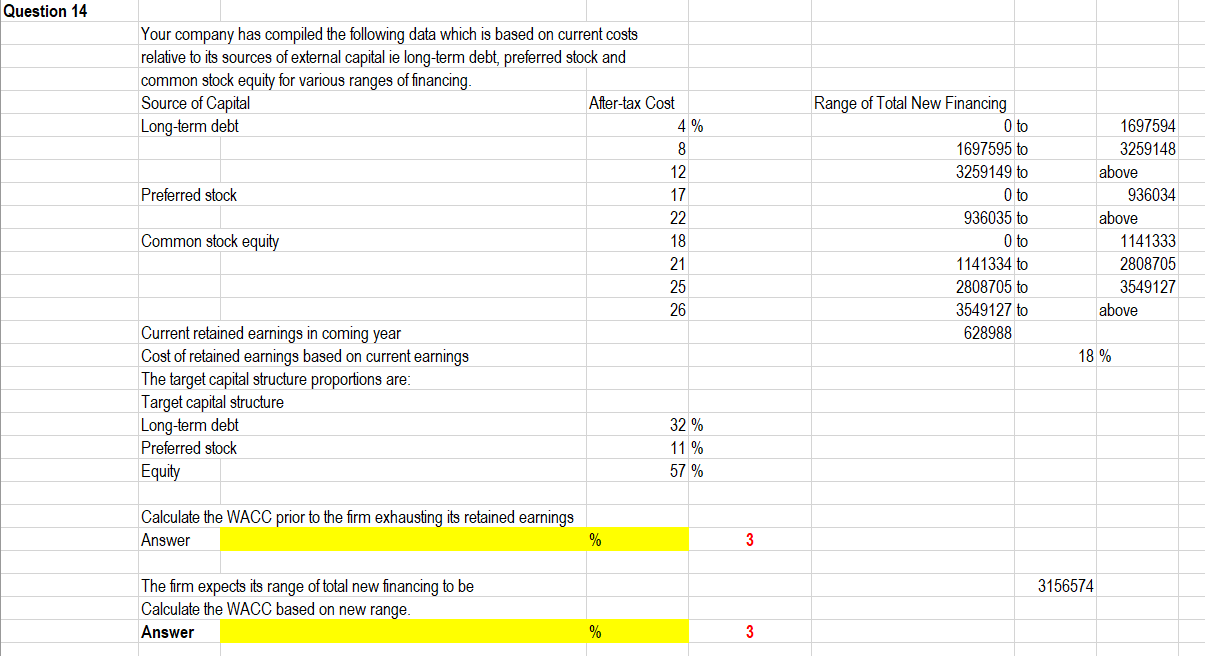

Question 14 Your company has compiled the following data which is based on current costs relative to its sources of external capital ie long-term debt, preferred stock and common stock equity for various ranges of financing. Source of Capital After-tax Cost Long-term debt 4 % 8 12 Preferred stock 17 22 Common stock equity 18 21 25 26 Current retained earnings in coming year Cost of retained earnings based on current earnings The target capital structure proportions are: Target capital structure Long-term debt 32 % Preferred stock 11 % Equity 57 % Range of Total New Financing 0 to 1697595 to 3259149 to 0 to 936035 to O to 1141334 to 2808705 to 3549127 to 628988 1697594 3259148 above 936034 above 1141333 2808705 3549127 above 18 % Calculate the WACC prior to the firm exhausting its retained earnings Answer % 3 3156574 The firm expects its range of total new financing to be Calculate the WACC based on new range. Answer % 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts