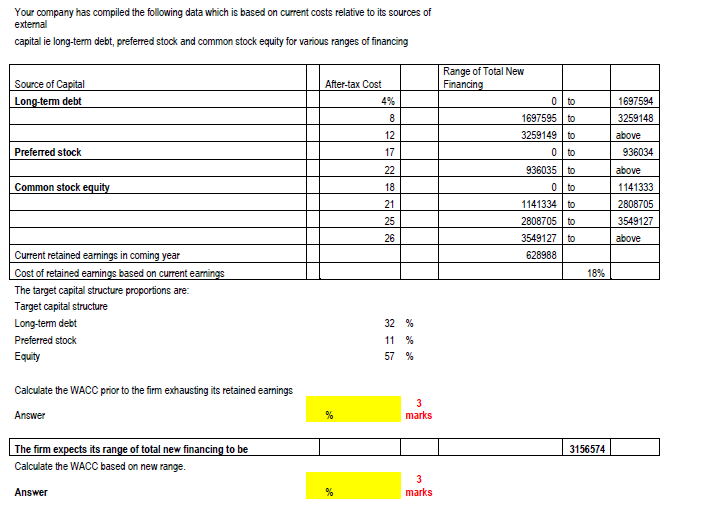

Question: Your company has compiled the following data which is based on current costs relative to its sources of external capital ie long-term debt, preferred stock

Your company has compiled the following data which is based on current costs relative to its sources of external capital ie long-term debt, preferred stock and common stock equity for various ranges of financing Range of Total New Financing Source of Capital Long-term debt After-tax Cost 4% 0 to 8 Preferred stock 12 17 22 18 1697594 3259148 above 936034 above 1141333 2808705 3549127 above 1697595 to 3259149 to 0 to 936035 to 0 to 1141334 to 2808705 to 3549127 to 628988 Common stock equity 21 25 26 18% Current retained earnings in coming year Cost of retained earnings based on current earnings The target capital structure proportions are: Target capital structure Long-term debt Preferred stock Equity 32 % 11 % 57 % Calculate the WACC prior to the firm exhausting its retained earnings Answer % 3 marks % 3156574 The firm expects its range of total new financing to be Calculate the WACC based on new range. Answer 3 marks % Your company has compiled the following data which is based on current costs relative to its sources of external capital ie long-term debt, preferred stock and common stock equity for various ranges of financing Range of Total New Financing Source of Capital Long-term debt After-tax Cost 4% 0 to 8 Preferred stock 12 17 22 18 1697594 3259148 above 936034 above 1141333 2808705 3549127 above 1697595 to 3259149 to 0 to 936035 to 0 to 1141334 to 2808705 to 3549127 to 628988 Common stock equity 21 25 26 18% Current retained earnings in coming year Cost of retained earnings based on current earnings The target capital structure proportions are: Target capital structure Long-term debt Preferred stock Equity 32 % 11 % 57 % Calculate the WACC prior to the firm exhausting its retained earnings Answer % 3 marks % 3156574 The firm expects its range of total new financing to be Calculate the WACC based on new range. Answer 3 marks %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts