Question: Question 15 5 pts Johnson Controls has a project with a cost of $7,000 and expected cash flow stream of $2,000 at the end of

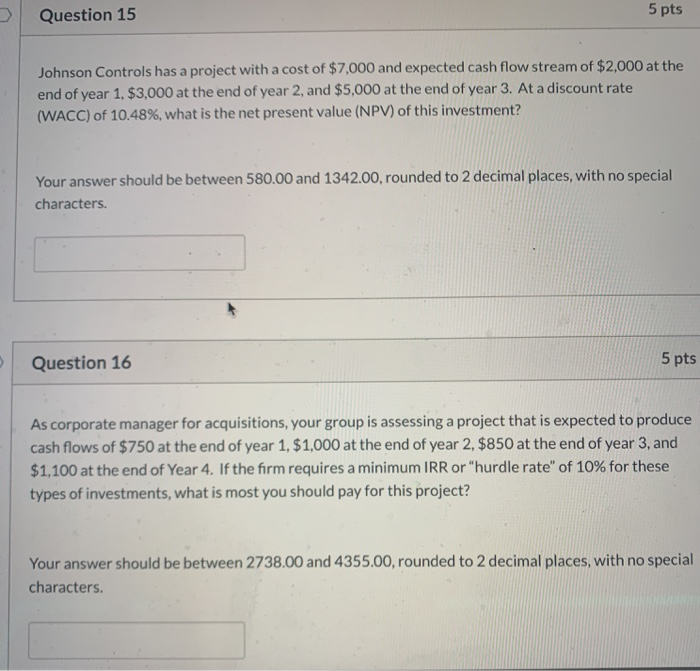

Question 15 5 pts Johnson Controls has a project with a cost of $7,000 and expected cash flow stream of $2,000 at the end of year 1, $3,000 at the end of year 2, and $5,000 at the end of year 3. At a discount rate (WACC) of 10.48%, what is the net present value (NPV) of this investment? Your answer should be between 580.00 and 1342.00, rounded to 2 decimal places, with no special characters. Question 16 5 pts As corporate manager for acquisitions, your group is assessing a project that is expected to produce cash flows of $750 at the end of year 1, $1,000 at the end of year 2, $850 at the end of year 3, and $1,100 at the end of Year 4. If the firm requires a minimum IRR or "hurdle rate" of 10% for these types of investments, what is most you should pay for this project? Your answer should be between 2738.00 and 4355.00, rounded to 2 decimal places, with no special characters

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts