Question: Question 15 8 pts A project has an initial cost of 80,000 and is expected to return 10,000 the first year, 40,000 the second year,

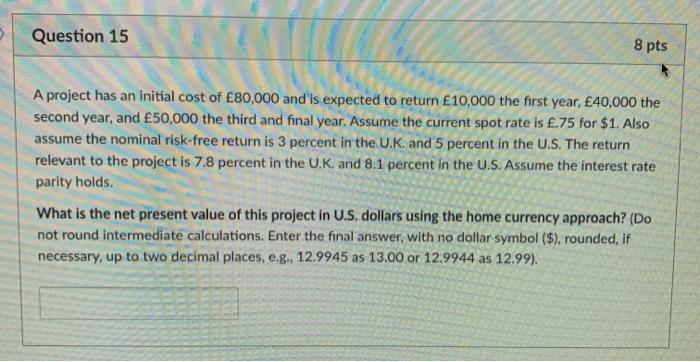

Question 15 8 pts A project has an initial cost of 80,000 and is expected to return 10,000 the first year, 40,000 the second year, and 50,000 the third and final year. Assume the current spot rate is .75 for $1. Also assume the nominal risk-free return is 3 percent in the U.K. and 5 percent in the U.S. The return relevant to the project is 7.8 percent in the U.K. and 8.1 percent in the U.S. Assume the interest rate parity holds. What is the net present value of this project in U.S. dollars using the home currency approach? (Do not round intermediate calculations. Enter the final answer, with no dollar symbol ($), rounded, if necessary, up to two decimal places, eg., 12.9945 as 13.00 or 12.9944 as 12.99)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts