Question: QUESTION 15 MNO's return on equity is 13% and its long-run retention ratio is 25%. The stock just paid a dividend of $4 25, which

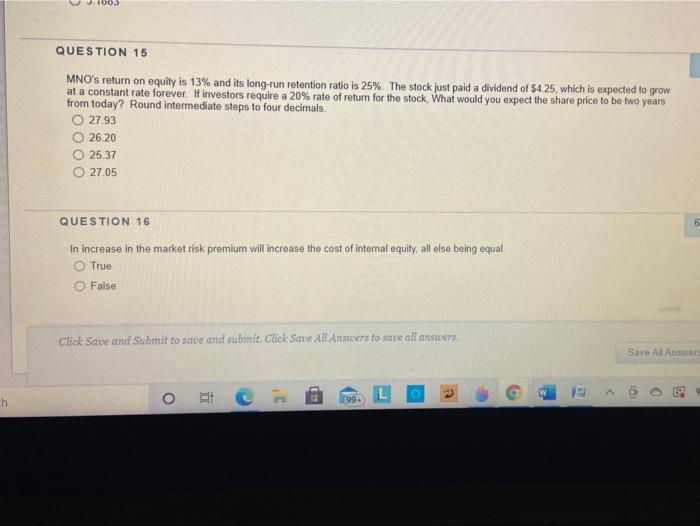

QUESTION 15 MNO's return on equity is 13% and its long-run retention ratio is 25%. The stock just paid a dividend of $4 25, which is expected to grow at a constant rate forever. If investors require a 20% rate of return for the stock, What would you expect the share price to be two years from today? Round intermediate steps to four decimals. O 27.93 26.20 25.37 27.05 QUESTION 16 6 In increase in the market risk premium will increase the cost of internal equity, all else being equal True False Chek Save and Submit to save and submit Chek Save All Answers to save all answers, Save All Answers ch o it 199

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock