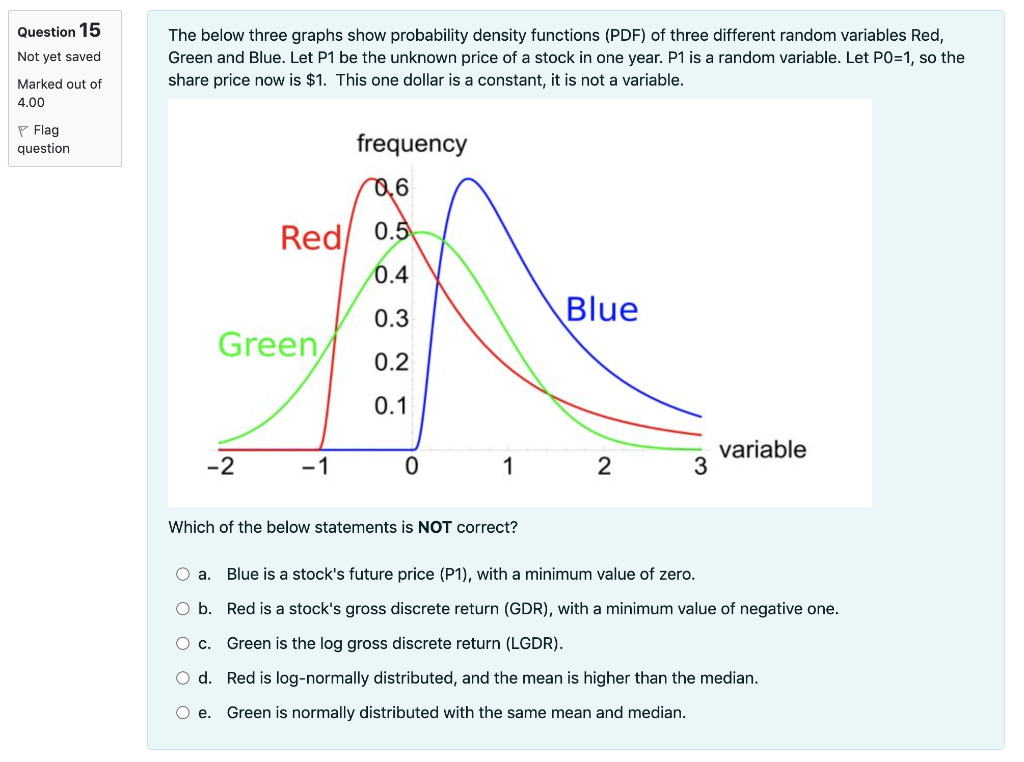

Question: Question 15 Not yet saved The below three graphs show probability density functions (PDF) of three different random variables Red, Green and Blue. Let P1

Question 15 Not yet saved The below three graphs show probability density functions (PDF) of three different random variables Red, Green and Blue. Let P1 be the unknown price of a stock in one year. P1 is a random variable. Let PO=1, so the share price now is $1. This one dollar is a constant, it is not a variable. Marked out of 4.00 Flag question frequency 0,6 Red 0.5 0.4 0.3 Blue Green 0.2 0.1 variable -2 -1 0 1 2 3 Which of the below statements is NOT correct? O a. Blue is a stock's future price (P1), with a minimum value of zero. O b. Red is a stock's gross discrete return (GDR), with a minimum value of negative one. O c. Green is the log gross discrete return (LGDR). O d. Red is log-normally distributed, and the mean is higher than the median. O e. Green is normally distributed with the same mean and median. Question 15 Not yet saved The below three graphs show probability density functions (PDF) of three different random variables Red, Green and Blue. Let P1 be the unknown price of a stock in one year. P1 is a random variable. Let PO=1, so the share price now is $1. This one dollar is a constant, it is not a variable. Marked out of 4.00 Flag question frequency 0,6 Red 0.5 0.4 0.3 Blue Green 0.2 0.1 variable -2 -1 0 1 2 3 Which of the below statements is NOT correct? O a. Blue is a stock's future price (P1), with a minimum value of zero. O b. Red is a stock's gross discrete return (GDR), with a minimum value of negative one. O c. Green is the log gross discrete return (LGDR). O d. Red is log-normally distributed, and the mean is higher than the median. O e. Green is normally distributed with the same mean and median

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts